You can download a PDF version here.

Introduction:

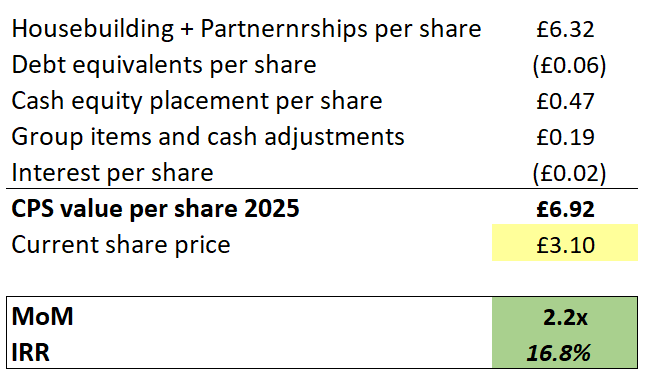

CSP decided to make an Equity Placing to raise £250m. The number of issued shares amounted to 16.6% of ordinary shares. The market took this negatively, and the stock went down 20%. Price decline should be considered in the context that the housebuilding industry went down as well, but not as significantly. This post will address what capital raise and Q3 update mean and how it impacts my thesis.

Impact of the Raise on the CPS’s Future Prospects

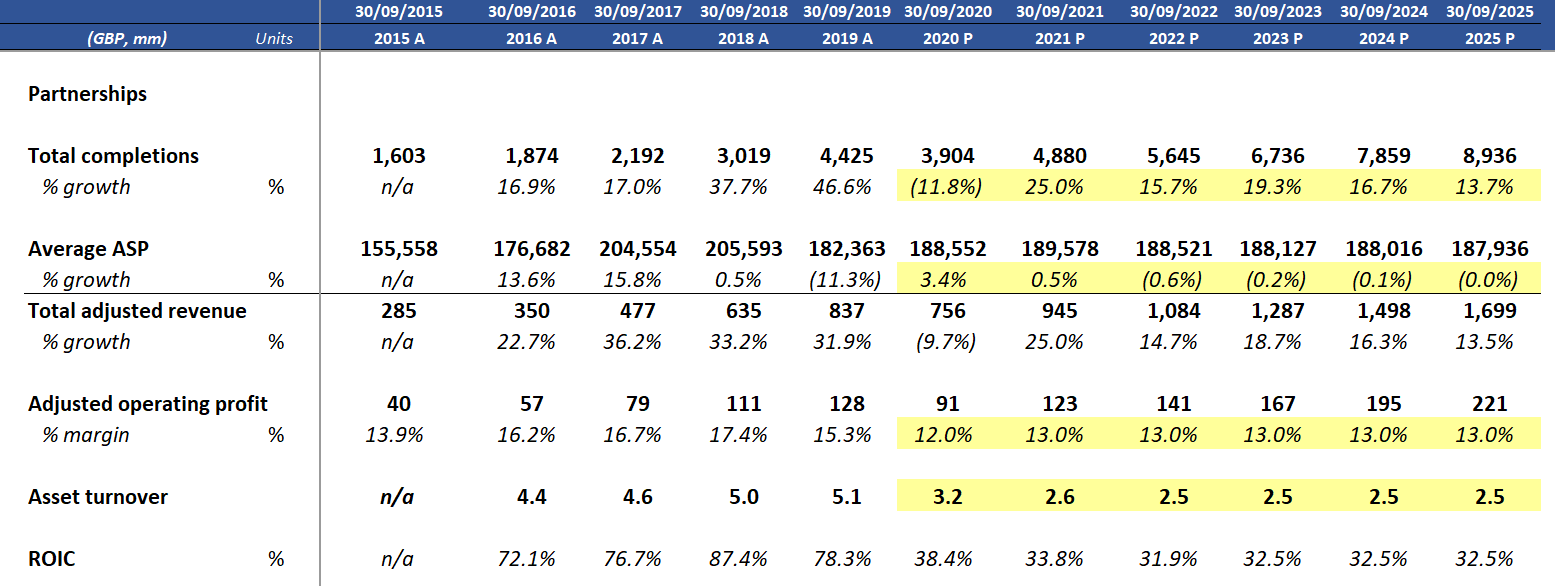

The money from the raise will be used to accelerate Partnerships growth (£150m) and to pay off debts resulted from COVID-19 lockdown (£100m). This raise will allow CSP to undertake some projects sooner than otherwise would be possible without funding. CSP will invest £90m in FY21 and £60m in FY22, which will produce an additional cumulative operating profit of £130m – £150m across FY22 and FY24 and more in later periods. Taking into account that CSP believes that its FY21 volumes expected to recover above FY19, the company is expected to deliver 14 – 19% revenue growth over the next five years (assuming 13% operating margin).

These investments accordingly will decrease CSP’s asset turnover and ROIC. Moreover, the management issued new guidance towards Group operating margin: 13% to 15%. Even accounting for obvious mix shift towards Partnerships, this implies a lower margin for the Partnership division. Group margin for FY19 is 16.5%, which means that the margin for Partnerships is guided to be around 13% if the Housebuilding division remains at ~18% margin. Consequently, assuming a 13% margin for Partnerships and additional investments of £150m results in ~32% ROIC.

This is far below 70%+ pitched in the thesis. According to management, there have not been any structural changes in Partnerships.[1] £50m of investment goes into accelerating 8 existing projects. The reason for the higher capital requirement for these projects is that 7 out of 8 projects are inside London. CSP delivering more RC frame-type buildings in London, which are private (not pre-funded) and take longer to build. In addition, these are big projects that require upfront infrastructure investing. £80m of investment goes into new projects in new regions, which supports the thesis in terms of geographical expansion. The rest (£20m) goes into a new factory, which should be ready in FY21.

The margin will change because of the change in tenure mix. CSP will increase the number of affordable and PRS completions relative to private, which have lower margins. This is done in order to take less risk since PRS and affordable houses are pre-funded. The management stated that future projects will still be 50%+ ROIC, and the company is aiming to return to this ROIC and 16% margin for Partnerships in the medium/long-term future.

Michael I. Scott – CFO of CSP:

“In terms of the return on capital, what I’d say on that is that the schemes that will go out and win for those new businesses will have the same characteristics as the schemes that we already operate on. So you can expect us to have typical partnerships characteristics in terms of margins and return on capital.”

It seems that the management decided to make a trade-off in terms of accelerating its revenue growth in exchange for ROIC. I view this as a positive sign because, at the previous rate of CSP’s ROIC (70%+), achieving higher revenue growth at a lower ROIC creates more value for shareholders than sustaining higher ROIC at lower revenue growth.

Additional Information from Q3 Update

- Guidance update: FY2021 volumes expected to recover strongly, ahead of FY2019 levels

- All sites are now operating at 85% capacity (productivity)

- The demand for housing is still strong, which is evident from 0.7 net reservation rate in the last 4 weeks and an increase of 34% in the private forward order book

- Increased demand for Partnerships – new institutional PRS

- More work secured – 9 years of work at FY19 volumes

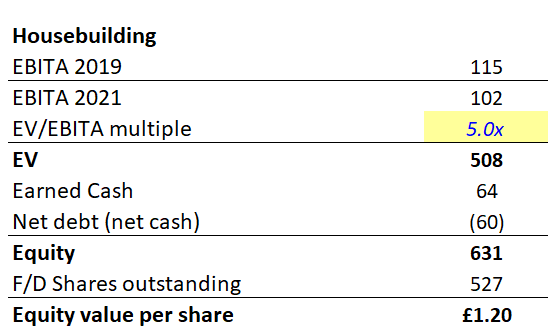

- The management is not planning to separate the Housebuilding division because it gives CSP good access to government and because CSP can use people from the Housebuilding division to accelerate the Partnerships division

Re-Assessing the Risk/Reward

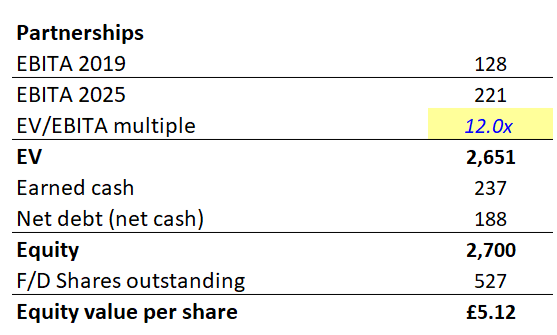

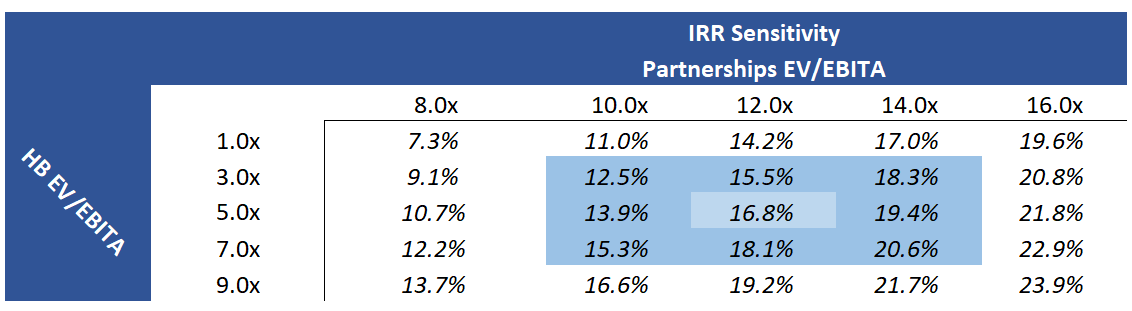

I still believe that the risk/reward for CSP is attractive. For my model, I accelerate revenue growth to add additional cumulative operating profit of £135m across FY22 and FY24. At the same time, I adjusted my previous forecast by changing the margin for Partnerships for 13% and decreasing asset turnover to 2.5x (~32.5% ROIC). Moreover, I decrease my multiple to 12x for Partnerships to be more conservative. Calculations have been adjusted for the increase in share count and cash. At the current price of £3.1 (12/08/2020), the investment in CSP presents a ~17% IRR opportunity. I believe that my estimations are conservative and provide a wide margin of safety.

Q3 Update revealed two additional risks:

1) The management might fail to deliver promised growth on £150m investment

2) The Partnership might be not as capital-light as presented by the management

Mitigants:

1) The management stated Q3 2020 Earnings Call that they are very confident in projections of additional operating profit of £130m – £150m. £50m of these investments going in the acceleration of existing schemes, so they are already contracted to receive a return from this investment.

2) I adjusted for this in this update by decreasing ROIC and exit multiple. Consequently, 32% ROIC is sufficient for the thesis, and 12x EV/EBITA multiple is conservative for such business.

-

Earnings Call 2020 Q3 ↑

[…] raises and focusing too much on the dividend. Due to the recent capital raise and investments, my expectations for the company’s expected ROIC decreased significantly to ~33% from 70%+ historical levels. […]