This is my second my write-up that I have ever written and the first post on my blog. I hope you enjoy it, and I would appreciate any feedback. You can download a better-formatted pdf version here.

Investment Thesis: LONG Countryside Properties (CSP LN Equity)

By Maxim Bogomaz

1. Elevator Pitch

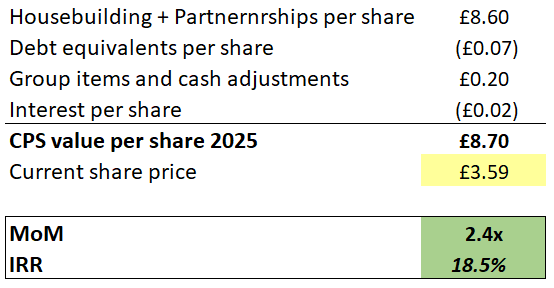

CSP is a compelling long (~2.4x return / ~18.5% IRR over a 5-year period) due to a strong combination of macro tailwinds (undersupply of housing) and company-specific factors. The company has two businesses with very different financial profiles (ROIC, margins, asset turnover), and Mr Market does not see outstanding unit economics of the better business … yet. This, in combination with COVID and Brexit uncertainties, created a fantastic buying opportunity. The first business is a traditional housebuilder with 25% ROIC and modest growth. The second business is a true gem: capital-light urban regeneration business that develops houses for local authorities with 50%+ ROIC, 8+ years revenue visibility and a multi-year growth runway. The Housebuilding business should be valued at ~5x EV/EBITA 2021 in line with public peers. Then, the gem business is available for purchase at ~9x EV/EBITA 2021, which is just far too low for a 50%+ ROIC business with a long growth runway.

2. Stock Basics

Stock Symbol: CSP

Stock Price: £3.59

F/D S/O: 450m

Market Cap: £1.62bn

Cash: £172m

Debt and DE: £331m

EV: £1.78bn

52 Week Range: £2.48 – £5.44

Free Float: £430m

EV/EBITA 2019: 8.3x

3. Business Model

The first business, Housebuilding (35% of revenue), is a traditional housebuilder that buys the land in advance, builds on it and then sells it to consumers through outlets and online. These investments make it very capital intensive.

In contrast, the second business, Partnerships (65 % of revenue), has a capital-light and low-risk model. The Partnerships division works together with local authorities (LAs) and housing associations to deliver medium to larger-scale urban regeneration projects. In these projects, CSP builds private for sale, private rented (PRS) and affordable homes in roughly equal quantities. The company acquires development projects through a competitive public bidding process. The land is sourced among development projects at a discount to the market value. The payment for land is usually deferred closer to the start of the projects. To improve working capital, CSP holds more than half of its land through options and sometimes provides affordable housing to LAs instead of cash payments for land.

The development projects from the time of the bid to finish last from three to fifteen years. This provides very high visibility of revenue into the future. To reduce the risk, CSP arrangements divide development into phases, which go through development appraisals to ensure the company has achieved a ‘priority profit’ (i.e., profit received before the residual land value is calculated) for the relevant project. If the development appraisal shows that the priority profit is not achievable, CSP will consider a range of solutions with the partner landowner to create a viable position going forward. CSP and LAs split 50/50 profit generated during a phase over and above the target profit. Any remaining cash payments owed by CSP to LAs are usually phased over the course of a project’s development, which contributes to low capital requirements. Furthermore, LAs pre-fund both PRS and affordable homes.

Low land cost, pre-funding of PRS and affordable homes, deferred payments of profit and for land and early land transfers result in 50%+ ROIC compared to Housebuilding ROIC of 25%.

4. Competition and Competitive Advantages

This section will focus on the Partnership division and will touch briefly the Housebuilding division since it is not the main focus of the investment thesis.

4.1 Competition

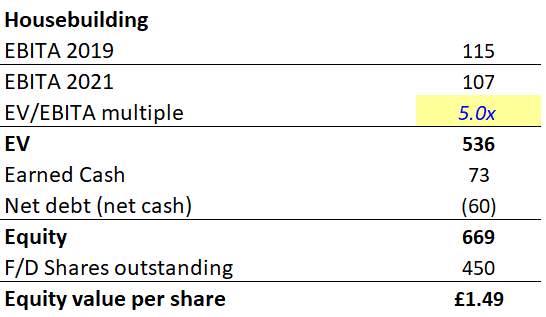

The Housebuilding division operates in the fragmented industry with a large number of players. Public competitors include Berkley Group (BKG), Vistry Group (VTY), Bellway (BWY), Redrow (RDW) and Taylor Wimpey (TW). The competition is not fierce because of the growing number of households and the shortage of housing. This is evident from a stable historical operating margin across the company and its competitors.

On the Partnerships side, the industry is fragmented, and competition is limited. Competitors are

a) Housing associations: L&Q

b) Social housing constructors: Morgan Sindall (MNGS)

c) Principal contractors: Kier (KIE), Bouygues (EN)

d) Volume housebuilders: Taylor Wimpey (TW), Berkley (WRB), Barratt Development (BDEV)

e) Regeneration companies: Gleeson (GLE), U+I (UAI), Urban Splash

The companies compete 70% on non-financial and 30% on financial criteria to secure development contracts. Non-financial criteria are assessed primarily on companies’ track record and reputation. This gives CSP advantage over its competitors, which will be discussed in the next section. Companies which focus on regenerations and have a track record in the industry are small and cannot take many large-scale projects.

4.2 Competitive advantages

The Partnerships business is protected by a wide moat with strong barriers to entry and economies of scale.

4.2.1 Barriers to Entry

There are four factors, which preclude competitors from entering the regeneration industry.

Firstly, CSP has a strong reputation, 30+ years of track record and developed relationships in the industry. This is key to win development contracts. Developed relationships allow the company to stay informed of potential partnership opportunities ahead of formal public procurement announcements and to conduct necessary preparatory work for public procurement processes. Volume housebuilders, social housing constructors and contractors are struggling to compete against CSP because of their lack of track record and lack of relationships with LAs and housing associations. Moreover, regenerations require a different kind of skill set compared to housebuilding, since it involves community management and engagement. This allows CSP to win contracts with a historical win rate of 40%.

Secondly, CSP has been incrementally improving its development process over many years. Large projects for regeneration are very complex because they involve building at scale, planning of how infrastructure and all housing fits together, relocation of people, destroying old houses or preparing brownfield land and cleaning up the waste. In such large projects, inefficiencies and lack of expertise accumulate into extra costs and longer time to finish. CSP has built its expertise over a 30-year period and has been improving its process incrementally step by step. The management provides an example of how most housing associations wanted to get into development 3 years ago, but, after understanding the challenges of development, dropped this idea.

Thirdly, there is a scarcity of experts in the field. The main constraint for CSP’ growth is the lack of projects teams and surveyors. CSP has been developing its own people through apprentices, trainee programs, graduate schemes and management development programs. It would be hard for a new entrant to find people and take time to develop the necessary infrastructure.

Finally, there is a large-time lap between initial investment and cash flow. The length of time between the bid and the beginning of the project is between 2 to 5 years, and the projects start generating cash flow on year 3. This means a new entrant would have its capital tight up for a long period of time without any return. Whereas CSP has multiple projects running in different stages of development.

4.2.2 Economies of Scale

Centralised buying, offsite manufacturing and efficient logistics allow Partnerships to benefit from economies of scale.

5. Industry Tailwinds

5.1 Undersupply of Housing

There is currently a need for 4m houses in England.[1] The number of households is projected to grow by 159k each year,[2] while the supply of housing has been consistently below 200k.[3] This means there is a long run away for growth for CSP.

5.2 Favourable Government Policies

The UK government set a goal to tackle undersupply of housing, setting a goal to reach 300,000 homes a year.[4] To achieve this, the government is providing funding for development of brownfield and delivery of affordable homes, increasing public procurement, incentivising authorities to deliver more homes, increasing of infrastructure funding and speeding up the planning system.[5] Moreover, it incentives buyers by providing supportive schemes, such as Buy to Let and Shared Ownerships among others. This is all very positive for CSP.

5.3 Healthy Mortgage Market

The mortgage market remains open with lenders prepared to offer highly competitive rates and up to 95% loan to value. As of 2020 Q1, the average fixed-rate loan is 2.06%.[6] Lenders’ valuations ensure that properties are not oversold and that Help to Buy values are in line with comparable sales without Help to Buy.

6. Management

6.1 New CEO

Iain McPherson became CEO in Jan 2020 after the retirement of the previous one. Iain has been in in the industry for 20 years and has been at CSP for 6 years in operational roles. This appointment shows that the company promotes from within, and it seems that Iain has the necessary experience to take the company forward.

6.2 Incentives Are Strongly Aligned with Shareholders

CSP compensation plans reward long-term performance. Executives’ bonuses are tied to adjusted operating profit, ROCE, operating margin and ‘recommend a friend’ score. Only two-thirds is paid in cash, while one-third is deferred in shares for a period of three years. The executive directors are eligible for a bonus in shares up to 200% of base salary, depending on achieving ROIC and adjusted EPS targets. The shares can be sold after 5 years from the grant period. Executive Directors are expected to build and maintain a holding in the Company’s shares to a minimum value of two times their base salary over a five-year period.

6.3 Great Capital Allocation Policy

The management since IPO stressed multiple times that its main priority is investing in the organic growth of Partnership business, which is our value generator. After this, CSP prioritises investments in the following order: organic growth of Housebuilding; acquisitions and geographical expansion; and dividends.

7. Why Does This Opportunity Exist

7.1 Housebuilding Hides the Results of the Partnerships Division

While both divisions operate in the housing industry, they have very different revenue visibility and risk and financial profiles. The housebuilding industry is not usually a place to look for quality businesses with predictable revenue, and this opportunity is not obvious from the first sight.

7.2 Brexit and COVID

The whole housing industry has been depressed since the announcement of Brexit. This is not surprising, taking into account its correlation with the UK’s economy. After the general election in Dec 2019, the situation became more certain and the housing industry started to rally. However, then, COVID hit. Both of these factors contributed to this buying opportunity.

The Partnership division is much more resilient and predictable compared to the housebuilding industry. In terms of COVID, CSP is already working at 80% capacity and has no liquidity problems.

7.3 Negativity Toward Regeneration

Some regenerations have caused protests and negative publicity because this process has been viewed as ‘displacement of the poor’. However, the research has shown that the main issue of people is the opaqueness of the process rather than the actual outcomes.

CSP engages and consults with the community in order to avoid this kind of problems. The company conducts consultations through the planning process, drops newsletters to the surrounding community to keep them informed of proposals and organises town hall meetings, consultation events and drop-in sessions.

7.4 Boring Company

Building houses is a very boring business with almost nothing new to it. A change in fortune in this kind of business is more likely to go unnoticed compared to, for instance, popular SaaS businesses, which is growing revenue double digits, introducing new products and capturing new markets.

8. Key Drivers of Value Creation

8.1 Expansion in Existing and New Geographical Areas

The Partnerships division can continue to expand organically and through acquisitions in new and existing locations in the UK. The division has been growing revenue above 20% over the last 5 years. As of FY19, the Partnerships division had future opportunities in terms of bids in progress and future bids for 21+ years of work at the current rate of completions. The number of future opportunities has been growing by 20% y-o-y. At the same time, the rate of completion has been growing above 17%. There is still about 80% of the UK for potential geographical expansion. As of FY16, Savills identified one million plot potential on London Authority Estates. Consequently, there is still a long runway for growth.

8.2 Panel Factories

The Partnerships division will speed up its rate of production and improve its margin by opening two more model panel factories in FY21 and FY23. The capacity of each factory is 3,000 units p.a., and they require almost no human intervention. Towards the end of FY19, the company opened a factory with the capacity of 1,500 units, which has contributed only 380 homes to FY19 results. Overall, this is an opportunity to increase the rate of production by 7,000 units p.a.. Factories make the process more efficient since it takes 6-8 weeks to build a house from slab to finished product using the modular build compared to 16-18 weeks building traditionally. Increase of the rate production and speed of building should significantly increase the rate of completions.[7]

9. Potential Catalyst

One potential event that can unlock the company’s value is the separation of the Housebuilding division. The management stated during Earnings Call 2019 that the division’s operating independently now, and that there are no structural barriers to separate them. They will consider this option once the environment normalises.

However, my thesis does not depend on this catalyst. CSP is a compounding machine, so catalysts are not needed as earnings growth will take care of itself.

10. Forecast and Valuation

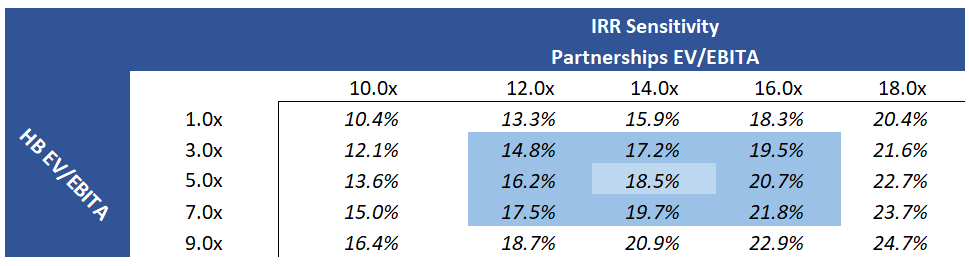

My five years projections result in 18.5% IRR or 2.4x MoM over the 5-year period. My tax rate assumption is 19%.

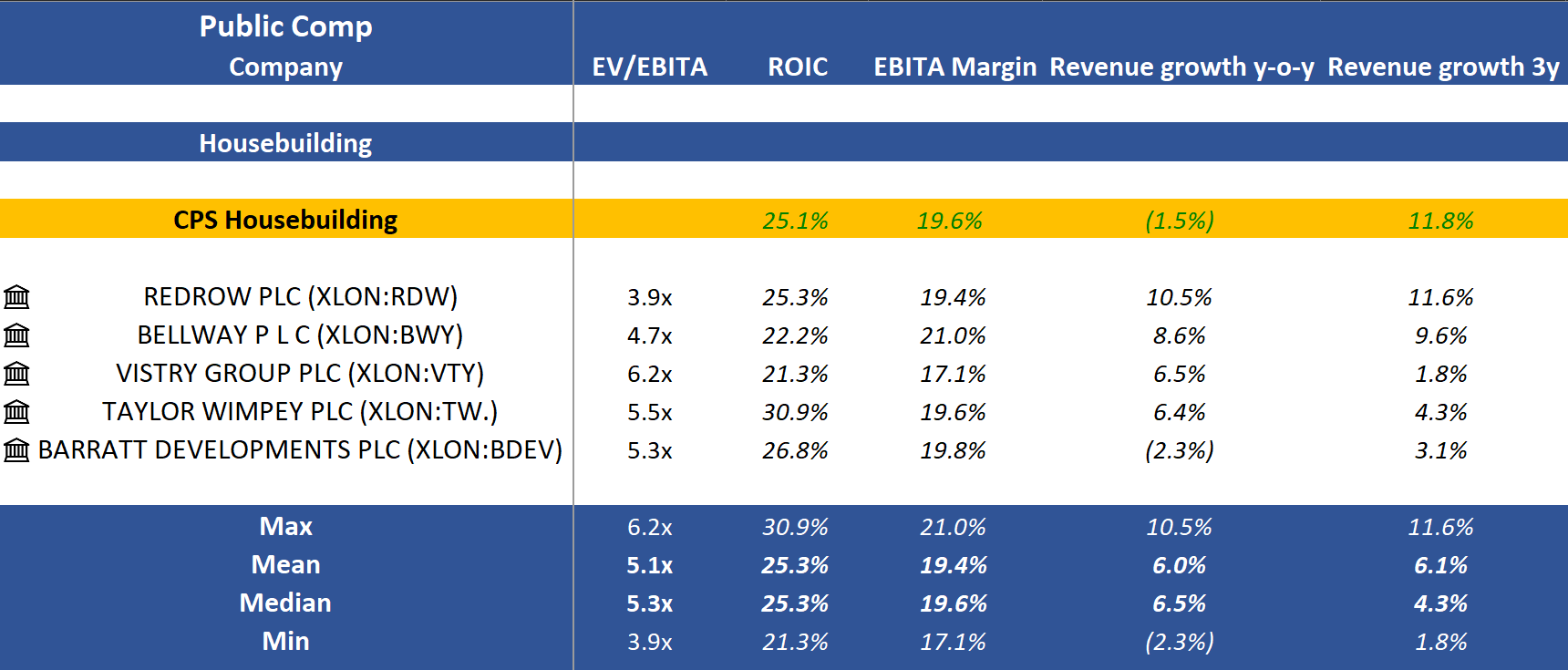

10.1 Partnerships

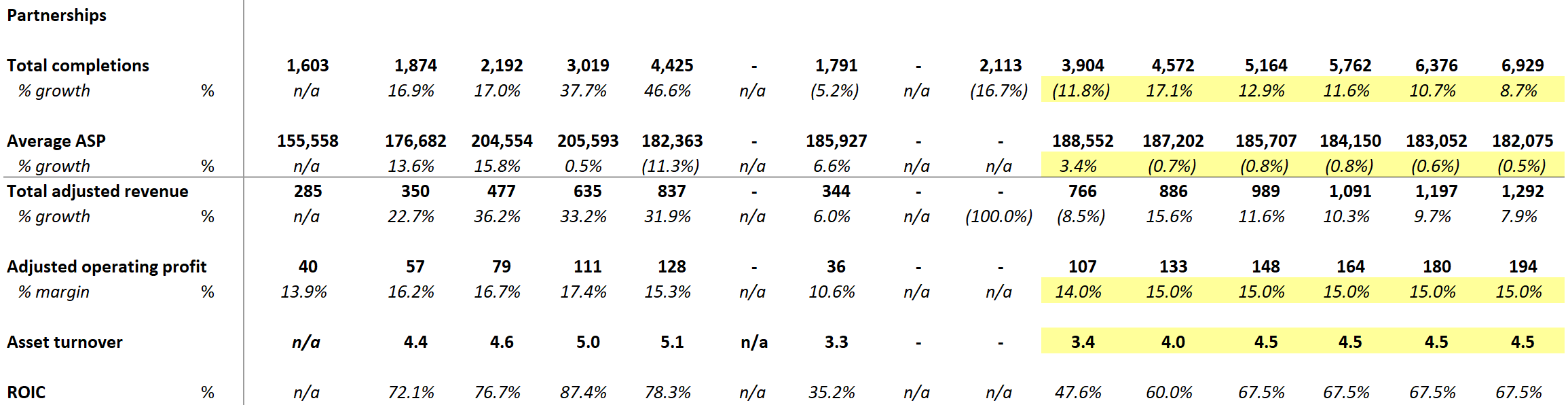

Partnerships completions are forecasted to grow around 8% to 13%, based on the management view, who said that the completions are expected to grow between 10% and 15%. This is quite conservative, taking into account new factories and historical growth of 17%+. Average selling price is slightly declining y-o-y because of the geographical mix. CSP is experiencing growth in the North of England, where houses are cheaper. Operating margin is forecasted at 15% since management mentioned multiple times that this number is sustainable, and the margin has been higher historically. Asset turnover is forecasted to slightly decline relative to historical because of new investments in factories and working capital, in order to support the growth.

Applying 14.0x EV/EBITA multiple, the value of the division is around £7 per share. While there are no direct comparables, I believe this is a fair multiple for 50%+ ROIC company with predictable revenue and long runaway for growth.

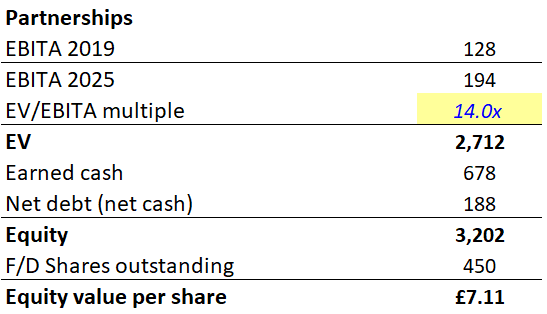

10.2 Housebuilding

The value of the Housebuilding division is determined based on 2021 EBITA and valuation of public peers. EBITA of 2021 is conservatively forecasted below 2019. Applying 5.0x EV/EBITA multiple results in £1.5 value per share. I believe that multiple of 5.0x is very conservative since my continuous valuation results in 7.7x EV/EBITA (WACC – 10%, Tax Rate – 19%, g – 0.5% and RONIC – 24%). Therefore, it provides a margin of safety with a potential upside.

10.3 CSP

After some group adjustments, the value of CSP should be around £8.7 as of 2025. This is 2.4x higher compared to the current price of £3.6 (12/07/2020). While all forecasting should be taken with scepticism, even if I am wrong, there is still a wide margin of safety.

11. Risks

11.1 Competition

While the barriers to entry are high, ROIC is very attractive, which should attract more competition. There is a potential for entrance from housing associations, volume housebuilders and international companies. Therefore, this area should be watched closely.

11.2 COVID

The implications of COVID on the future of the country is still unknown. There is also a potential for the 2nd wave of COVID. The UK is slowly opening all the shops, pubs and other entertainments. Nevertheless, the company has the necessary funding to survive this, and this does not affect the thesis in the long term.

11.3 Macroeconomic Factors

Both divisions are affected by macroeconomic factors, such as housing inflation, cost inflation, the mortgage market and consumer confidence.

11.4 Government Policy

The number of available contracts depends on government policy towards procurement. While it is unlikely to be a threat in the short to medium term, this might change in the future.

12. Key Formulas

ROIC = Adjusted EBITA/Invested Capital

Adjusted EBITA = Operating Profit + Share of Operating Profit from Joint Ventures and Associates + Non-underlying Items

Invested Capital = Equity + Net Debt – Intangible Assets(net of deferred tax)

13. References

-

Glen Bramley, ‘Housing Supply Requirements Across Great Britain: for Low-income Households

and Homeless People’ (Crisis, November 2018) ↑

-

Office for National Statistics, ‘Household Projections in England: 2016-based‘ (20 September 2018) ↑

-

Ministry of Housing, Communities & Local Government, ‘House Building; New Build Dwellings, England: December Quarter 2019’ (26 March 2020) 9 ↑

-

Adam Forrest, ‘Brexit Won’t Stop Britain Building, Says Sajid Javid’ (The Big Issue, 28 November 2017) ↑

-

Ministry of Housing Communities & Local Government, ‘Planning for Future’ (March 2020) ↑

-

FCA, ‘Mortgage Lending Statistics – June 2020’ (09 June 2020) ↑

-

Completion is the moment of transfer of the house from the seller to the buyer. ↑