First idea of the year.

Disclamer: I have a position in this security at the time of posting and may trade in and out of this position without informing. This idea is not investment advice.

Investment Thesis: LONG TransAct Technologies (TACT LN Equity)

Executive Summary

TACT is a hidden growing company inside a stable company situation rebounding from the COVID impact. The casino segment provides printers for slot machines and is a cash machine in a duopoly with high switching costs. The product is critical to the slot machine’s operations while being a small fraction of the overall cost. This business in combination with some change from other small segments is worth ~80% of the current market cap (excluding cash) in a normalised environment. This means you can buy the back-office restaurant and c-store software and labelling business with 60%+ GM for 0.5x FY23 ARR. Most of this ARR is already in the backlog. Moreover, the company has one of the best products on the market, operates in the industry with secular tailwinds and recently signed a partnership with Apple, which will allow it to penetrate mostly greenfield opportunities.

Table of Contents

1. Capital Structure and Metrics Overview 2

2. Why Does the Opportunity Exist? 2

3.2. Food Service Technology (FST) 3

3.3. Transact Services Group (TSG) 4

4. Customer Value Proposition 4

5. Competitive Advantages and Competition 5

6. TAM and Industry Tailwinds 6

7. Management, Activists and Board 7

9.1. Recovery in the Casino Business 9

9.2. Growth of BOHA! Terminals 9

12.1. Management, Culture and Inability to Build a Strong Team 13

12.2. Potential Internal Conflict 13

12.5. Customer Concentration 14

12.6. No Ownership of Software 14

12.8. Lack of Margin Disclosures 14

1. Capital Structure and Metrics Overview

Stock Symbol: TACT

Stock Price: $10.35 (30/12/2021)

F/D S/O: 10.3m

Market Cap: $106m

EV: $87.7m

52 Week Range: $6.9 – $17.2

Free Float: 85.7%

Average Daily Volume: 0.02m

2. Why Does the Opportunity Exist?

- Low Liquidity

- Small Market Cap

- Almost Flat Stock Chart

- Aggregate numbers hide BOHA! progress

The stock does not screen well and historical financials look bad.

3. Business Model

The company reports 6 segments: Food Service Technology, POS Automation, Casino and Gaming, Lottery, Printrex and Transact Services Group. Lottery got discontinued and Printrex is also heading in the same direction. (3.3) Transact Services Group and (3.4) POS Automation are no longer the focus of the company, so I will touch on them briefly. The main drivers of value are (3.1) Casino and Gaming and (3.2) Food Service Technology (FST).

3.1. Casino and Gaming

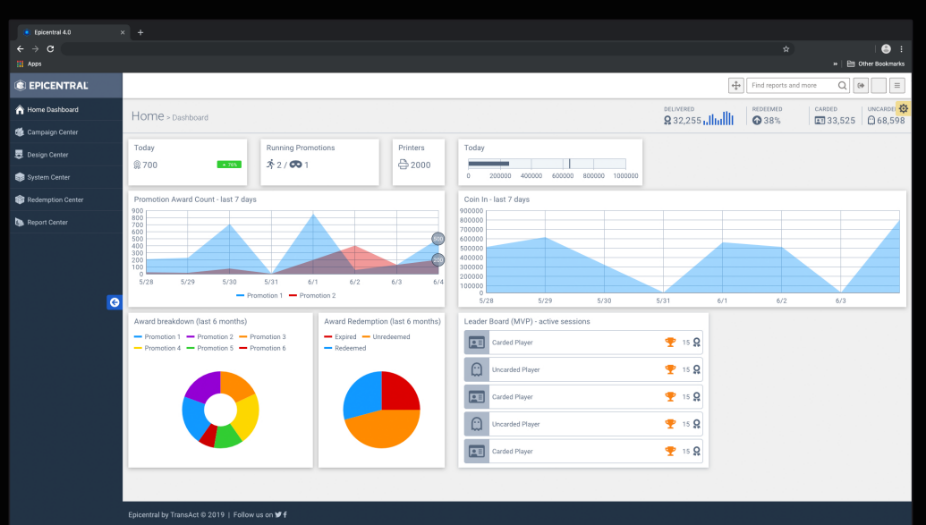

This segment has two main products: printers (Epic Edge, Epic 950, Epic 880) and promotional software (Epicentral). Printers are used in slot machines, kiosks, sports betting and other gaming machines that print tickets or recipes instead of issuing coins at casinos. The software is complementary to printers, which allows giving customers custom-designed coupons while they play. Printers are sold to slot machine manufacturers, who incorporate printers into slot machines and, in turn, sell completed slot machines directly to casinos and other gaming establishments. Casinos are decision-makers on what goes into slot machines, and they are the customers of TACT. Casinos replace 5-10% of their slot machines every year which creates an ongoing revenue. This is a lumpy business because it depends on casinos’ CapEx. As of FY21, the segment will be 37% of revenue. I estimate that this segment had a 60% gross margin pre-COVID and 50% now.

Picture 1

3.2. Food Service Technology (FST)

The main driver of the company going forward is a cloud-based back-of-house solution for restaurants and convenience stores, BOHA!. The solution consists of a suite of software-as-a-service-based modules and related hardware. Available modules are food safety labelling, temperature monitoring of food and equipment, inventory management, timers, checklists, food recalls, equipment service management, delivery management, media management and food preparation. All these modules are accessible through one portal. Customers usually start with one or a couple of these modules and then add more. However, convenience stores just do the labelling. This means restaurants have less variable revenue. The split is ~60% convenience stores and ~40% labelling.

Installed hardware depends on the use cases. There are terminals or workstations, handheld devices, tablets, temperature probes and temperature sensors and gateways.

The sales cycle is usually from 6 to 18 months. It is quicker for convenience stores, but longer for restaurants. It takes time to install hardware for multiple modules and customise the software for a client. The installation starts with a testing period in a couple of locations and then proceeds to full rollout. As of FY21, the segment will be 34% of revenue.

Picture 2

3.3. Transact Services Group (TSG)

The TSG segment sells consumable products (including POS receipt paper, inkjet cartridges, ribbons and other printing supplies), replacement parts, maintenance and repair services, refurbished printers, and shipping and handling charges. Maintenance services include the sale of extended warranties, multi-year maintenance contracts, a 24-hour guaranteed replacement product service and other repair services for printers and terminals. As of FY21, the segment will be 16% of revenue.

3.4. POS Automation

This segment sells several models of printers utilising thermal printing technology. POS printers are used primarily by quick-serve restaurants located either at the checkout counter or within self-service kiosks to print receipts for consumers or print on lineless labels. The main customer here is McDonald’s. As of FY21, the segment will be 12% of revenue.

4. Customer Value Proposition

The value proposition of the Casino and Gaming product is clear. Issuing paper with a won amount is superior to giving coins. It is important for casinos to have reliable printers since otherwise they will lose revenue on slot machines, and replacing them is troublesome. Moreover, Epicentral helps casinos to retain clients for a longer time in a casino with free spins and food discounts and incentivises customers to return with a voucher that works after a certain period of time. This is a much better experience than e-mailed vouchers since it allows to promote to customers in real-time.

On the BOHA! side, the product provides value to the customer in multiple forms (see Picture 3).

For restaurants, the main value-add is a reduction in labour requirements. Restaurants have to label the food (raw and produced) with the date of expiration for it. Restaurants have been doing it with pen and paper, updating the inventory manually. It is much easier with BOHA!, which allows employees to print everything and keep track of the inventory. Another example is that cooks are required to record the temperature of all items prepared as a result, which typically takes two to do (one holding a clipboard, the other operating a thermometer). The temperature monitoring module simplifies this process through the use of a Bluetooth thermometer that is linked to the platform, automatically recording the temperature for a cook (and reducing labour needs as a result). This is especially relevant at times of labour shortage. In addition, it allows the customers to keep their food fresh and reduce food safety incidents. Another value-add is reliable printers that can operate in the kitchen environment. The restaurant back-of-the-house is a noisy environment for connection (a lot of people, devices and heavy doors) and harsh in terms of conditions (greasy hands and high temperature)

On the convenience store side, under FDA regulations, they must label grab-and-go food with nutritional, caloric and dietary information.

Picture 3

5. Competitive Advantages and Competition

In the casino segment, a printer is a critical part and a small percentage of the total cost of a slot machine. While the printer’s cost is low, its failure will cause the whole machine to stop working. The low cost of a printer makes the customer less sensitive to switch.

Moreover, there are high switching costs. Strict legal regulations are imposed on casino management and the manufacture and sales of gaming machines. These regulations not only require authorisation from the appropriate authority to sell gaming machines but also in most US states and jurisdictions printers are regarded as a type of gaming machine. This means that their testing, approval and sale requires the same authorisation as that for gaming machines themselves. In the case of a printer replacement, a slot machine has to be re-approved.

The market is essentially a duopoly. TACT has 35-40% in the US, 45% in Europe and 70% in Asia. The majority of the rest of the market is controlled by Japan Cash Machine.

In the FST segment, there are no strong competitive advantages, and it is not an amazing business. Switching costs are low, consumers are price sensitive and barriers to entry are not huge. The main advantages that BOHA! has are a first-mover advantage, integrated modules into one platform, no reliability on partnerships for printers and lower label costs because their printers allow for different sizes and shapes of labels and established supplier relationships.

At the moment, BOHA! is one of the leaders in the market. The main competitor is Jolt. Some ex-employees of TACT believe that Jolt will be a market leader. Jolt got an infusion of cash from a private equity firm in Jan 2018. Since then, they really strengthened their sales and marketing team. Jolt hired a new SVP of Global Sales & Marketing , Jeff Pinc, who came from MICROS POS. He knows SaaS software and knows how to sell to restaurants. As of 2021, Jolt has 2.3m revenue and 1k customers.[1] Jolt and TACT products have around the same price and similar quality of product and services. However, TACT has three advantages. Firstly, TACT is slightly cheaper for customers because of less expensive labels, which was achieved through better labelling source supply. This is one of the reasons customers switched in the past. Even a small difference in price adds up over time. Secondly, Jolt does not own its printers and it works with partners to supply them. This has two issues. First, Jolt’s printer can do only one label size at a time. So, if a customer wants a different size label, he needs either to change labels for different size labels or to buy an extra printer. Changing labels creates extra waste and can cause issues. Second, I learnt from ex-employees of Jolt that they sometimes have problems with connectivity between printers because it is hard to connect the software to “foreign” hardware.

The third best vendor is probably Avery Dennison. This is one of the oldest players in the market. They also serve labelling solutions to offices, post offices and UPS stores. The competing product is Freshmarx. The product is very cheap because of the low cost of labels, but the product is also very bad. It was not built for the restaurant environment. The pieces get damaged all the time, and the software is not very good. However, Avery Dennison recently acquired ZippyYum to strengthen its Freshmarx offering.[2] ZippyYum is a startup that develops and sells software and hardware solutions for operational automation and inventory management for food retailers. ZippyYum is a third-party developer that built BOHA!. Therefore, Freshmarx offering should improve over time and become more competitive. Nevertheless, Freshmarx is still only a small part of Avery Dennison, and it is unlikely that it will be as competitive as Jolt and TACT who focus on this segment of the market.

The last competitor with a full-service offering is ITD Food Safety. However, their offering looks very outdated and runs on mini PCs.

There are also some other small vendors that compete in some modules with TACT, but do not have one platform, which is important for competing in this market (For example, CMC Daymark, Integrated Control Corp, Squadle, CrunchTime).

One important point is that many might think that market leaders in the POS industry, such as Toast and Par Technology, are competitors of TACT. This is not the case yet. While Par Technology has acquired back-of-the-house software, Restaurant Magic, the only modules where they compete are inventory management and food preparation. From talking to PAR and Toast and ex-employees, I concluded that they are probably a threat in the medium to long term. It would be a slight strategy shift for them to focus on back-of-the-house software. POS is so competitive that they need to focus on that. To compete with TACT, they will have to build a new recipe management database for calory count and breakdown of the nutritional value of products. To achieve this, they will need to get integrations with food companies, which are reluctant to sign new vendors (according to an ex-employee of TACT). Moreover, they would have to either acquire hardware and build relationships with label suppliers or work with partners. Also, selling hardware would mean decreasing the overall gross margin of the company, which the management can be very reluctant to do. Therefore, developing back-office products would take some time and probably would not be very profitable for these companies, while still leaving them behind in the market.

Nevertheless, they can acquire these modules as bolt-on acquisitions. From talking to PAR, they are looking at online ordering capabilities, delivery management and kitchen automation. So, they are already thinking of entering new back-office capabilities, and they are planning to do it through acquisitions. To conclude, I see PAR and Toast competing in some or most modules against TACT in the medium to long term future.

6. TAM and Industry Tailwinds

There are 150k convenience stores and 661k restaurants in the US, while TACT has 8.8k terminals. Penetration is very small, and most restaurants still do it through pen and paper.

There are four industry tailwinds for TACT.

Firstly, higher food costs. US Food Inflation is at its highest since 2008.[3] Therefore, restaurants and convenience stores search for ways to mitigate food waste.

Secondly, lack of labour and higher labour costs. “One-third of current hospitality workers report being “dissatisfied” or “very dissatisfied” with their jobs, which is twice the pre-pandemic level. As a result, 58% of hospitality workers say that they are planning to quit their jobs before the end of 2021.”[4] The main reason for quitting (55%) has been low pay. American workers are quitting their jobs at unprecedented rates in 2021.[5] Since TACT allows to reduce labour requirements and makes the manual job easier for employees, it solves the problem for its customers. However, on the flip side, restaurants lack labour to the extent that they do not have spare people to keep the restaurant open for the installation of BOHA!.

Thirdly, the growth of the Grab-and-Go industry means more labels for TACT. Grab-and-Go has high adoption across millennials and Gen-Z. For example, “while 19% of consumers overall select grab-and-go food items, nearly 30% of millennials purchase these items.”[6] Starting from 2020, “nutrition fact panels for grab-and-go prepared food items will need to adhere to new FDA guidelines, including the use of larger, bolder type for serving size and calories, more accurate serving sizes, and the addition of a new callout for added sugars, among other changes.”[7]

Finally, food safety and employee safety are becoming more important. FDA began a new initiative, the “New Era of Smarter Food Safety.” In this initiative, they advocate for the modernisation of traditional retail food safety approaches. FDA encourages “the use of commercial smart kitchen equipment capable of automatically monitoring time and temperature processes” and the use of “new digital tools and incentives that prompt desired behaviours, such as handwashing and manual temperature monitoring”.[8] BOHA!’s temp and timer modules address these issues. While these are not requirements, they indicate the direction of the industry.

7. Management, Activists and Board

The CEO and Chairman of TACT is Bart Shuldman. He has been CEO of TACT for 26 years, and the stock has been flat. From talking to ex-employees, I learnt that Bart does a lot of micromanagement, that he can be hands-on and hands-off, depending on the day and that he does not listen much to employees. One day he acts as a CEO of the company and another day he goes into sales. Historically, he has been overpromising in his communications to shareholders. Moreover, Bart has been doing hardware most of his life, and he has little experience with the software.

While this is all negative, and I do not think that he is a high-quality CEO, I think that it is not all that gloomy. Firstly, he has been shutting down underperforming segments and focusing on BOHA!, which is already rare amongst long tenure CEOs. Secondly, he has shown that he can learn and adapt. From talking to ex-employees, in the first years of BOHA!, one of the reasons for the lack of adaption amongst customers was that they were selling BOHA! as a hardware product. TACT was giving a 1-year warranty for hardware but wanted a 3-year contract on software. Also, many clients did not like high hardware prices upfront and wanted to shift it on the subscription side, but TACT did not go with that. Employees told management that they need to shift the business model but were ignored. However, in more recent earnings calls, Bart says that he understands that recurring revenue is the main value driver and that he is open to whatever negotiation they have to do as long as they do not lose money on the terminal. This is supported by a reduction in price per terminal in financials. Moreover, he talks about monthly hardware contracts for the terminals.[9] All this shows that he is willing to change his mind.

Overall, Bart is already close to retirement age, and he is living high on the hog. So, I think he will be interested in an exit opportunity.

The CFO is Steve DeMartino. He has been CFO for 12 years and has been with the company for 18 years. While there had been material weaknesses in the company’s internal control of financial reporting, it did not lead to financial restatements. Weaknesses in the internal control mean that the company did not design and maintain effective controls over the completeness and accuracy of the information included in key spreadsheets supporting accounting records. The company already established an elaborate plan to address these weaknesses. Other than that, I heard from ex-employees that the CFO is one of the people in the company who has the company’s best interest at heart.

On the incentive side, the CEO owns ~6% of the company and receives 500k in cash salary, while CFO owns 3% and has 340k salary. Overall, insider ownership is 12%. There has been a lot of positive compensation structure developments in the company. The 2021 compensation program incorporates changes to both the annual and long-term incentive design. The annual bonus is now based 60% on quantitative objectives and 40% on measurable strategic objectives. Quantitative objectives are based on FST terminals or software installations (50%) and the achievement of FST recurring revenue growth (50%). This incentivises the management to focus on BOHA!. The weighting of performance stock units was increased from 30% to 50%. Long-term incentive awards became 100% equity and there is now a clawback policy[10]. Moreover, they implemented stock ownership guidelines for the CEO and CFO. Within three years (i.e. by March 2024), the CEO must hold two-times base salary and the CFO must hold a one-time base salary in TransAct stock.

I think these changes were pushed by activists in the company. At the moment, three activists hold together around 20% of the stock (Grand Slam Asset Management 6%, Harbert Discovery Fund 5.5% and 325 Capital 8%). From talking to one of the activists, they are very aware of issues at the company and are working with the board to address them. While they are not looking to change the management yet because it will distract the company from realising the opportunity, they are very incentivised to make the company work. Especially, considering how illiquid the stock is.

On the board level, there are 6 members of the board, and there have been 2 quality replacements who have restaurant industry experience. Haydee Ortiz Olinger was appointed to the board in July 2018. She worked for more than twenty years at McDonald’s as Global Chief Compliance and Privacy Officer. Her experience of working in a well-structured company such as McDonald’s should have a positive impact on TACT. Another addition in June 2019 was Emanuel Hilario, who is CEO and President of The ONE Group Hospitality (parent to the STK steakhouse and Kona Grill brands). His restaurants adopted BOHA! and made a video about how effective the product is. I think activists will bring more quality board members going forward. Of course, there is also a lack of an independent chairman, which might lead to various problems.

8. Culture

The culture at the company is not very good, and this is one of my main concerns with the company. A quick view of Glassdoor reviews reveals 2.3 ratings with 22% CEO approval and 31% friend recommendation. Some comments indicate that culture has a lot of office politics, high people turnover and that employees are not heard. My calls with ex-employees confirmed these points. In my experience, companies with bad cultures throw a bad surprise out of nowhere. Good culture is especially relevant for a company with a software product in an environment where it is very hard to get developers.

9. Key Value Drivers

9.1. Recovery in the Casino Business

The casino business has been down due to COVID. Most casinos did not replace their printers and did not expand because their facilities were closed and/or worked at a limited capacity. From FY11 until FY19, casino revenue fluctuated between $18.6m and $29.1m with an average of $23.7m and a median of $22.7m. As the situation stabilises over time, the casino business should return to ~$21m+ revenue. I think it is conservative to assume that it will happen by FY23.

9.2. Growth of BOHA! Terminals

TACT can increase the number of BOHA! terminals to at least ~23k by FY23. As of 3Q 2021, BOHA! had installed 8.8k terminals. TACT was contracted by 7-Eleven to install 10K terminals, and the company already installed 2.7k terminals as of Q1 (39% of all terminals). Assuming 50% of installs came from 7-Eleven in Q2 and Q3 (870 terminals), there are still 6.4k terminals to go. Moreover, 7-Eleven acquired Speedway in May 2021, which has 3.8k locations. While it is not clear yet whether they intend to roll out BOHA! in these locations, there is a strong possibility for this to happen. The company guides towards 10k-11k locations by the end of FY21 (1250 – 2250 new locations). While I would take this CEO’s estimates with a pinch of salt, he says that they think they can install over 10k terminals for FY22. This does not sound too unrealistic (3.6k terminals from new clients) and this would mean that the company can get to ~20k terminals by FY22. Alternatively, as a sanity check, the company claims to have a $150m pipeline over 3 years. At $1.1k per hardware terminal sale and $1.2k ARPU per terminal, it implies ~32k terminal opportunity.[11] Of course, this calculation is an oversimplification. CEO expects at least 50% conversion, which brings it to 16k terminals. I would not trust these projections, but even half of the expected conversion (25%) implies good growth potential.

In October 2020, the company signed a partnership with Apple. TACT is the only restaurant back-office vendor for Apple. This gives BOHA! brand more recognition and opens a lot of growth opportunities. Also, it reduces the upfront hardware barrier cost for TACT, since many restaurants already have iPads in the restaurants, and they just need to buy the workstation. TACT has a $150m pipeline (over a 3 year period) and claims that Apple brought 50% of this. This means Apple already created a $75m pipeline. While it is unknown what % of this will materialise into actual sales, this definitely shows some traction. Square also announced that they are going to use the iPad with their POS Terminal and Toast is already using it. This means iPads will get more adoption going forward, which results in more potential opportunities for TACT. In addition, the CEO stated that Apple is willing to bring BOHA! internationally as they felt strongly about the technology, which creates potential optionality for BOHA!.

TACT has an opportunity to grow in the SMB space. In Q2 2021, TACT began selling to SMB clients. There are a lot of SMBs in the US which still use pen and paper, and it should be a great opportunity. The company already signed 16 clients in Q2 (69 terminals). While still small, it should grow as TACT scales its S&M team.

TACT can cross-sell its BOHA! solution to casino clients once they start working at full capacity. Most casinos have restaurants in them, and it should be easy to cross-sell for them. I was not able to estimate potential opportunities for this, as TACT does not disclose the number of casino clients.

At this point, potential TAM is big and unpenetrated with mostly greenfield opportunities. Since BOHA! is one of the best full-service solutions on the market, and there are not many of them, it definitely has the potential to capture market share. Nevertheless, there is a risk that once TACT finishes the contract with 7-Eleven, it will not be able to grow at the same pace.

9.3. ARPU

ARPU fluctuates a lot due to variable components and does represent a full picture due to a mismatch between revenue and terminal shipments. ARPU per terminal can be as low as $400 and as high as $2,000, depending on the modules used. Many restaurants were not interested in the solution in the COVID times, which resulted in a higher number of c-stores compared to restaurants. ARPU per c-store tends to be slightly higher than per restaurant at the start. Restaurants only label products with a shelf-life, and those labels tend to be 1×1 or 2×2 (not very expensive). Whereas c-stores are wrapping labels all-around containers and they are with colours and have their brand on it (much more expansive). However, restaurants usually start with one module and then add others, after which they get to c-store ARPU range.

I think the company will get to $1.2k ARPU by FY23. In Q2 and Q3 FY21, adjusted ARPU was $1,179 and $1,016 respectively. Adjusted ARPU is this quarter recurring revenue divided by last quarter terminals to account for the timing mismatch. This calculation might slightly overstate ARPU. Comparing it to normal ARPU ($1,041 and $922 respectively for the same period), I think ~$1,000 is a reasonable estimate for the near term. As restaurants and c-stores normalise from COVID, ARPU should go higher because more people will buy grab-and-go, all restaurants can work at full capacity and TACT can upsell more modules to restaurants. Moreover, ARPU will get more stable, as the Apple partnership should help TACT to get more restaurants.

9.4. Margin Expansion

I think the overall margin of the company should grow over time. TACT does not report margins for each segment, so I estimate margins based on my conversations with TACT and information about similar products.

I estimate the gross margin for the Casino and Gaming segment to be around 50% now and 60% pre-COVID. According to the management, Casino and Gaming business has been having gross margin above corporate level, which is 40% as of Q3 FY21 and ~48% over the last 3 years. There are a lot of fixed costs in gross margin (manufacturing overhead expenses), so it decreases more than the revenue. This segment does not need many S&M expenses due to operating in an oligopoly and having the most revenue from returning customers for printer replacements. While EBITDA margin is hard to estimate due to distortion by investment in less profitable segments historically, I think it should be at least 30%, but potentially higher. As the COVID situation and inflation pressures normalise, the Casino and Gaming segment should return to 60% gross margins.

For the FST segment, I estimate ~15% GM for hardware, ~80% GM for software and above 50% GM for labels. For hardware, I took GMs from Lightspeed and my previous estimates from PAR Technology. Software GM is around 80% – 90%, and TACT confirmed that labels GM is above 50%. As restaurants become a bigger part of the mix, GMs should grow.

For other segments (POS automation and TSG), I estimate 20 – 30% GM. POS automation sells thermal printers primarily to McDonald’s, which has high bargaining power. TSG (consumables and maintenance services) has a probably higher margin than POS automation.

On the corporate level, it is very hard to estimate future costs. It all depends on how fast TACT will scale its R&D and S&M teams. G&A should scale over time. Overall, the company will probably be EBIT negative for the next 3 years.

10. Valuation

TACT is a 22 – 28% IRR opportunity with a low downside and further upside. I assume that casino and restaurant operations normalise in FY23.

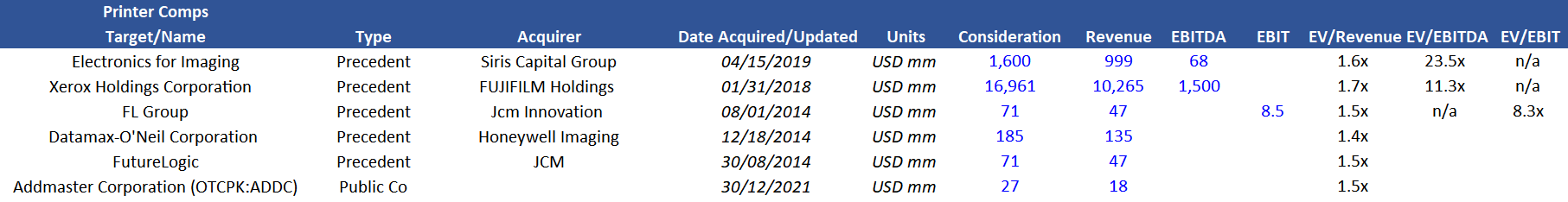

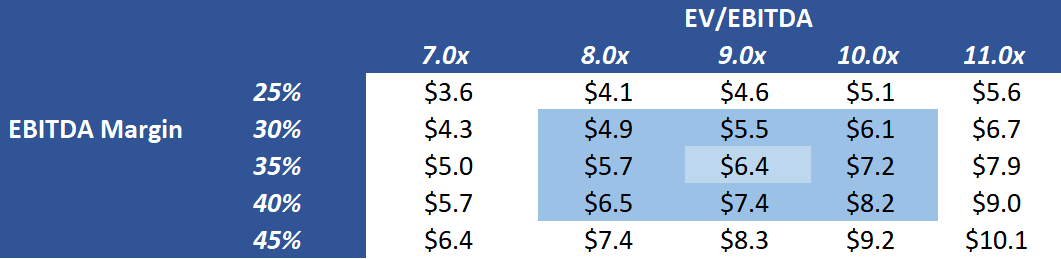

The Casino and Gaming business is worth $66m or ~$6.5 per share. Normalised revenue for the Casino and Gaming business is 21m. This business requires little R&D and S&M expense. At 60% GM, the business should have a 30 – 40% EBITDA margin. This means a $7.4m EBITDA. Precedent transactions in the printer industry have an average of 1.5x sales multiple (see Picture 4).

Picture 4

However, these companies had been selling commoditised printers at much lower gross margins (typically 20-35% for this industry) and required much more S&M. One very similar comp is an acquisition for FutureLogic by JCM for 1.5x sales. FutureLogic manufactures and sells ticket printers units equipped with slot machines to the gaming market. However, it also was selling many commoditised hardware products, which diluted the mix and probably deflated the multiple (see Picture 6). Credits to Matthew Sweeney for this discovery. Moreover, the company that can grow FCF at a stable rate should be worth at least 8x to 10x EBITDA. It should be worth even more to an acquirer, for example, a slot machine provider, who can get revenue and margin synergies. At 9x EBITDA, this segment is worth $66m or $6.4 per share.

Picture 5

Picture 6

The other two non-FST segments, POS automation and TSG, are worth around $6.5m or $0.7 per share. POS automation normalised revenue will be around $5m, and I think its GM is 20% – 25%. I do not think it deserves 1.5x sales multiple as precedent printer comps because of high client concentration. Therefore, I value it at 1x sales. TSG has higher GM (30% – 35%) but is declining. I guestimate it is worth around 0.5x sales and estimate $3m sales in FY23. Therefore, the business is worth $73m or $7.1 per share excluding the FST segment. In other words, it is worth 75% of the market cap excluding cash (adjusted for the next 2 years of cash burn). This implies that the FST segment is conservatively worth ~1x ARR FY23.

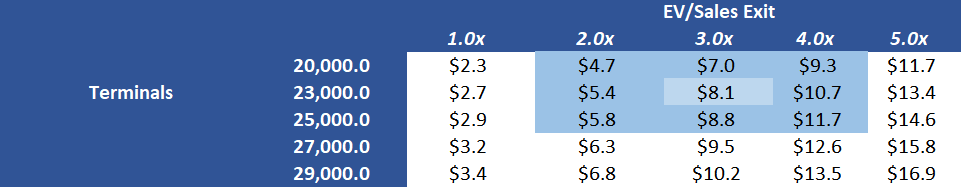

I believe the FST segment is worth at least $8 – $10 per share and my conservative estimates have much more further upside to them. It is very probable that ARPU will get to $1.2k post-COVID. Key questions are the number of terminals and valuation multiple. 20k terminals assume fulfilling current contracts and almost no growth from new customers. Taking into account 7-Eleven expansion with Speedway, Apple partnership and SMB initiate, this is highly unlikely. I think the company will have somewhere between 23k and 27k terminals and should be worth at least 3x ARR (See Picture 7). At 23k terminals and $1.2k APRU, it is 28m ARR or $8 per share. If the company executes and signs more customers, I do not see why it can not trade at 4x or even 5x ARR. Consequently, I think there is further upside to my conservative estimates. Obviously, it is not enterprise software and has lower GM due to labelling, and I do not think it should trade at 10x ARR.

Picture 7

There are two important questions left: cash burn and share dilution. The company has $18.7m in cash as of Q3 FY21. I estimate $8m cash burn until the end of FY23, which includes an additional $4m in R&D, $5m in S&M and a modest $1.5m increase in G&A. This means the company does not need to raise any capital in the near term and will still have $10.7m cash left ($1 per share). Nevertheless, TACT registered a shelf for up to $50m. This shelf was put in place in case there are more lockdowns and businesses will get closed. The company has very little SBC, and the current F/D S/O is 10.3m.

Putting it all together, $6.5 for casino and gaming, $0.6 for POS automation and TSG, $8 – $10 for FST and $1 of cash. This gives us ~$16 – $18 per share or 22% – 28% IRR with further upside with potentially better execution and multiple expansion. At the same time, the downside is limited because of the value of the Casino and Gaming Business and the very probable installation of at least 18k terminals. The main risk to this is the extension of COVID, which might result in the longer realisation of normalised numbers and bigger cash burn with even a possibility of a capital raise in the worst-case scenario.

11. Catalysts

While I do not think this investment needs a catalyst, because overall results will improve over time, the sale of the Casino and Gaming business should be happening in the future. The management does not want to sell at the moment because revenue and margin are down to temporary factors. The casino and Gaming business operates by itself and there would be no problems in selling it. From talking to activists, they already have been pushing for the sale of this business, and I think it is just a matter of time.

12. Risks

12.1. Management, Culture and Inability to Build a Strong Team

As I stated before, the management is not very good and the culture is awful. In these types of situations, a nasty negative surprise can come out of nowhere. Moreover, it is very difficult to hire and retain employees in such an environment. Especially at the time when it is so hard and expensive to hire (in particular software engineers). Senior VP of Sales, Ray Walsh, recently left the company, which might hinder the company’s growth in the short term. CEO jumps between the sales and the CEO job, which does not allow him to focus on what is important.

12.2. Potential Internal Conflict

This might happen if activists try to replace the CEO. The company is at a pivotal inflation point and internal conflict will lose its momentum and potentially make it lose market share to competitors.

12.3. Competition

Restaurant IT is a highly competitive space. Competition is intensifying between existing players and new players. Moreover, big players, such as Toast and PAR will potentially enter the industry in the medium term.

12.4. Execution

The company still needs to prove that it can grow beyond its contracts with 7-Eleven and Hoshi Sushi, which were responsible for most of the BOHA! growth and development.

12.5. Customer Concentration

7-Eleven and Hoshi Sushi account for most of BOHA! terminals and McDonald’s account for most of POS automation.

12.6. No Ownership of Software

TACT developed BOHA! with a third-party developer, ZippyYum, which owns the source code and got sold to Avery Dennison. TACT has a non-exclusive license until 2031. I will speak on this point with the CEO in Jan 2021 to understand what they are doing about this and what the terms of the contract are. I assume they have some kind of protection in place. I heard from another investor that they have the right to buy the software. ZippyYum was acquired for ~$6.6m (excluding contingent consideration), so it should not cost too much. However, it is unclear how it will develop, taking into account that the acquirer is a competitor.

12.7. Capital Raises

TACT is at the growth stage and might need more capital going forward. However, they have enough cash to finance their growth for now.

12.8. Lack of Margin Disclosures

My margin estimates might prove inaccurate.

12.9. Illiquid

- https://getlatka.com/companies/jolt ↑

- https://printers.averydennison.com/en/home/about-us/global-events/avery-dennison-acquires-zippyyum.html ↑

- https://tradingeconomics.com/united-states/food-inflation ↑

- https://www.joblist.com/jobs-reports/q3-2021-united-states-job-market-report ↑

- ibid ↑

- https://www.cspdailynews.com/snacks-candy/grab-go-foods-speak-millennial-generation ↑

- https://www.transact-tech.com/upgrade/restaurant-solutions/automated-labeling-facilitates-grab-n-go/#:~:text=Beginning%20in%202020%20(so%20basically,added%20sugars%2C%20among%20other%20changes. ↑

- https://www.fda.gov/food/new-era-smarter-food-safety ↑

- 2020_4Q_TACT_Earnings_Call ↑

- Any incentive-based compensation awarded after this date to Executive Officers and other covered employees will be subject to a clawback policy. Incentive-based compensation means any cash or equity award which is earned based on the achievement of financial measures. The Committee will have the authority to recoup any award in which a financial restatement would have resulted in a lesser award paid out or if an Executive Officer or covered employee committed a significant legal or compliance violation in connection with employment. ↑

- Terminal opportunity = 150m/(1,100 + 1,200 * 3) ↑