A pdf version is avaliable here.

Browning West, the third-largest shareholder in Countryside Properties PLC, with a 9.4% stake started to take activist actions in CSP. The activist wrote letters to the board,[1] demanding to immediately appoint Browning West’s CIO, Usman Nabi, to the Board, replace Countryside’s Chairman and task the New Chairman with a mandate to “Let Partnerships Prosper”. “The new Chairman will work with the reinvigorated Board to urgently address three key issues: (i) reassess the current operating plan to see if there is an opportunity to improve return on capital employed and margins in 2021 and 2022, (ii) initiate a process to thoughtfully execute the separation of Housebuilding to create a stand-alone Partnerships business, and (iii) construct a prudent capital allocation policy that significantly reduces the risk of any future equity offerings and maximises total long-term returns for all shareholders.”[2]

Following the activist’s actions, Countryside Properties’ Chairman David Howell will step down from the board in 2021. Moreover, the company has appointed Rothschild & Co to advise on a break-up at the beginning of December 2020, which would result in Countryside focusing on building homes for housing associations, local authorities and the private rented sector. I also expect that the new board will probably change the CEO. The activist’s letter stated that “Mr McPherson was appointed CEO earlier this year and had no prior experience serving as the CEO of a large PLC”. The CEO sold 15,185 shares following the activist’s intervention.

I view this as a very positive sign. This brings back the spin-off catalyst and indicates that the capital allocation of the company will improve. Historically, the company was not investing enough into the Partnerships division, making dilutive capital raises and focusing too much on the dividend. Due to the recent capital raise and investments, my expectations for the company’s expected ROIC decreased significantly to ~33% from 70%+ historical levels. However, this was still an attractive investment because of the quality of the business and because of the cheap price. In terms of the potential CEO replacement, Iain just became CEO recently, and he might just need some guidance rather than replacement.

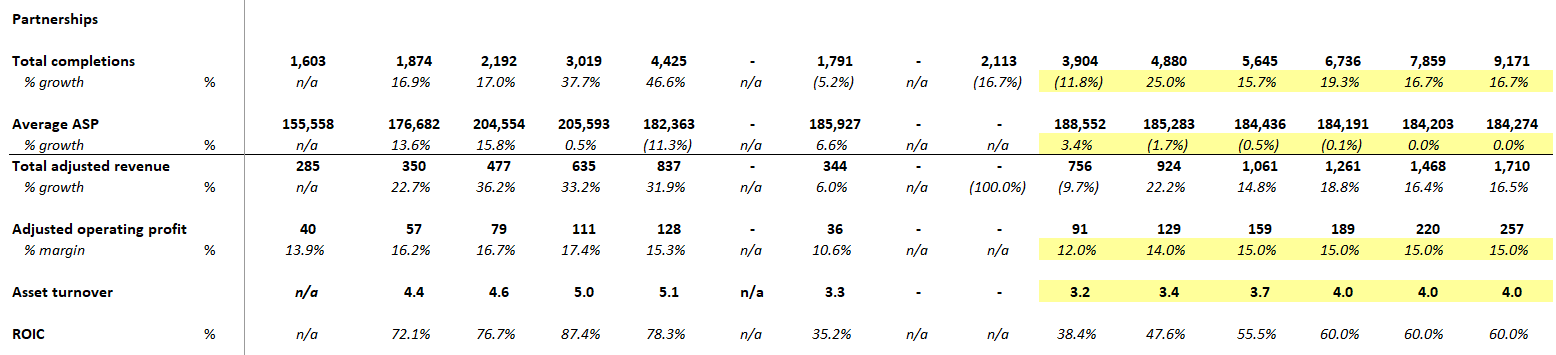

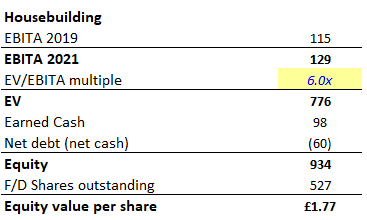

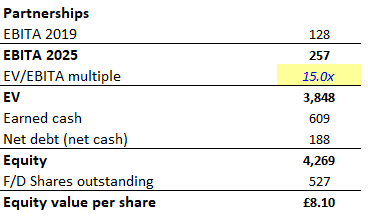

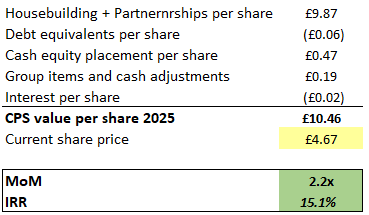

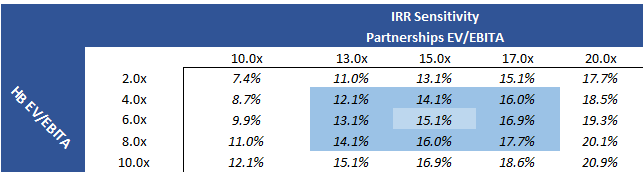

Going forward, I still see at least 15%+ IRR potential. This is conditioned on the fact that the company can return to Partnerships’ 50%+ ROIC by 2022. This would require the company to return to 15% EBITA margin and 3.5+ asset turnover, which are still below historical levels for the last 4 years. I value Housebuilding spin-off at 6x EBITA 2021 Exit, on par with peers. For the Partnerships division, I expect it to re-rate to at least 15x EBITA. I believe this is conservative for the business with 50%+ ROIC, 16%+ operating income growth and very high revenue visibility. My expected revenue CAGR of ~18% is also very conservative. This implies the rate of completions below 2019 levels, while the company should increase it with new modular factories. After the spin-off and new chairman, we should get an amazing business with solid capital allocation. Even if the execution underdelivers, the downside is very limited due to the cheapness of the shares. Therefore, the risk/reward is very attractive.

- https://propertyindustryeye.com/browning-west-calls-for-countryside-properties-to-let-partnerships-prosper/ ↑

- https://www.prnewswire.co.uk/news-releases/browning-west-calls-for-countryside-properties-to-let-partnerships-prosper–827734052.html ↑