Please find formated write up here.

Executive Summary

Kambi is a leading B2B odds and risk management provider for online and retail sports betting to B2C gaming operators, who is well-positioned to capitalise on the legalisation of the US sports betting market. The US sports betting has been legalised in 2018, which created a new market for Kambi with a potential TAM of at least €1.1bn at maturity. The company already has ~14% market share in the US (excluding DraftKings), based on Q1 2020 LTM revenue. Even if Kambi’s market share remains stable, this implies at least 2.5x revenue increase. Furthermore, Kambi will be able to capture more market share, as it has recently secured major operators, such as Penn National and BetAmerica, who are together expected to exceed the current market share of Kambi. At the same time, Kambi will benefit from operating leverage with ~30% EBITDA margin and ~70% incremental margin. Kambi almost does not have any competitors, and its leadership in the industry is protected by high barriers to entry, high switching costs and benefits from economies of scale. The company should be worth at least double in 5 years’ time. This is a fantastic opportunity to acquire a leader in the industry with 20%+ historical revenue growth for 7x EV/Sales or 21x EV/EBITDA (1Q 2020 LTM). To put this into perspective, some other US-listed gambling companies trade at 14x+ EV/Sales with negative EBITDA. This opportunity exists because the ownership base is predominantly European, which has less familiarity with the complicated US sports betting market, and which is very ESG focused. The stock is also not under the radar for US investors.

Table of Content

1. Capital Structure and Key Metrics 2

5. Customer Value Proposition 7

9. Main Drivers of Value Creation 13

9.1 Expansion and Legalisation in North America 13

9.3 Expansion and Legalisation in Latin America 15

14.3 Customers Leaving Kambi After Achieving Certain Scale 20

14.5 Kindred as the Biggest Customer 21

1. Capital Structure and Key Metrics

Stock Symbol: KAMBI.ST

Stock Price: 254 SEK or €24 (24/09/2020)

F/D S/O: 31.2m

Market Cap: €750m

EV: ~€720m

52 Week Range: 58.1 SEK – 274.8 SEK

Free Float: 24.57m

Average Daily Volume: 150k

EV/Sales: 7.2x Q1 2020 LTM

EV/EBITDA: 21x Q1 2020 LTM

2. Company’s History

Kambi was founded as a part of Unibet (Kindred) in 2010, being responsible for its odds and risk management (back-end). Current CEO and other founders saw an opportunity to provide back-end services to other sports betting providers. As Kambi started to grow and secured a number of clients, the company needed independence to grow quicker, focus on its sports betting technology and get clients’ trust. In 2014, Kambi spun off from Unibet and became an independent public company.

3. Industry Structure

I will start with a discussion of the industry, which will then help to better understand Kambi’s business model.

In the sports betting industry, the key players are B2C sports betting providers. Examples of B2C providers are Bet365, Penn National and William Hill. They have two main business models. Firstly, some sportsbooks are fully integrated with their own menu (front-end) and betting lines/risk management (back-end). Secondly, some sportsbooks rely on an outsourced provider or providers for these capabilities. Every operator is unique in its own way. For instance, William Hill has its menu and compiles its odds in-house. However, it uses Kambi for compiling odds with its own front-end capabilities in Sweden. Another example is FanDuel, which uses the IGT for the back-end and GAN for the front-end.

The front-end is responsible for the user interface, CRM, account management, payments, KYC and mobile apps. This business model has little operating leverage and is a highly competitive business. It has to spend most of their income on customer acquisition and, consequently, its expenses grow with its revenue. In contrast, the back-end business model is high margin with considerable operating leverage and differentiated offerings. The back-end business model is responsible for odds compiling, customer intelligence and risk management. The back-end business model requires a very small incremental cost to add new users on the platform, and it can reinvest into R&D to improve its offering. The front-end and the back-end are two separate businesses, and they have very little synergy between each other. Kambi is one of these back-end providers. The value chain is well-demonstrated on Picture 1.

Picture 1[1]

The industry is fragmented into legal, grey and black markets. Legal markets are highly regulated, and each country has its regulations and tax regime. Gray markets have no explicit regulations, and black markets prohibit sports betting. Kambi operates only in regulated markets.

Kambi’s two primary markets are Europe (FY19: 61% of revenue) and America (FY19: 37% of revenue).

Europe is a mature market, where most countries are regulated and in which the industry is fragmented without dominant winners. European retail and online betting market size is around €20bn in GGR and is expected to grow ~6% a year.[2]

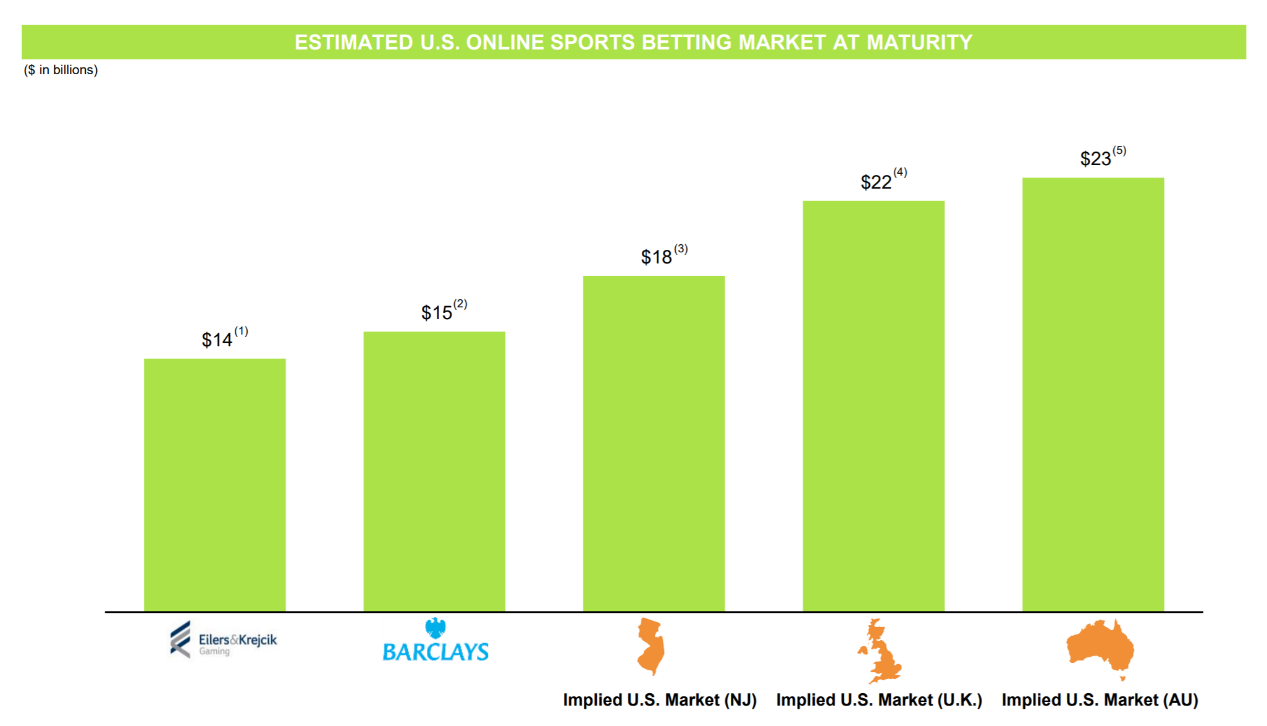

North America is just in its infancy and each state is adopting different regulations. The current market size is €0.7bn in GGR. Potential market size is hard to estimate and varies by source, but overall, the projections look very optimistic for Kambi. Vixio and Kambi estimated that the market will grow up to ~€7.2bn by 2024.[3] While Morgan Stanley estimated the market to be ~€6bn by 2025.[4] Estimates of the USA market at maturity are between ~€12bn and ~€20bn (see Picture 3).

Picture 3[5]

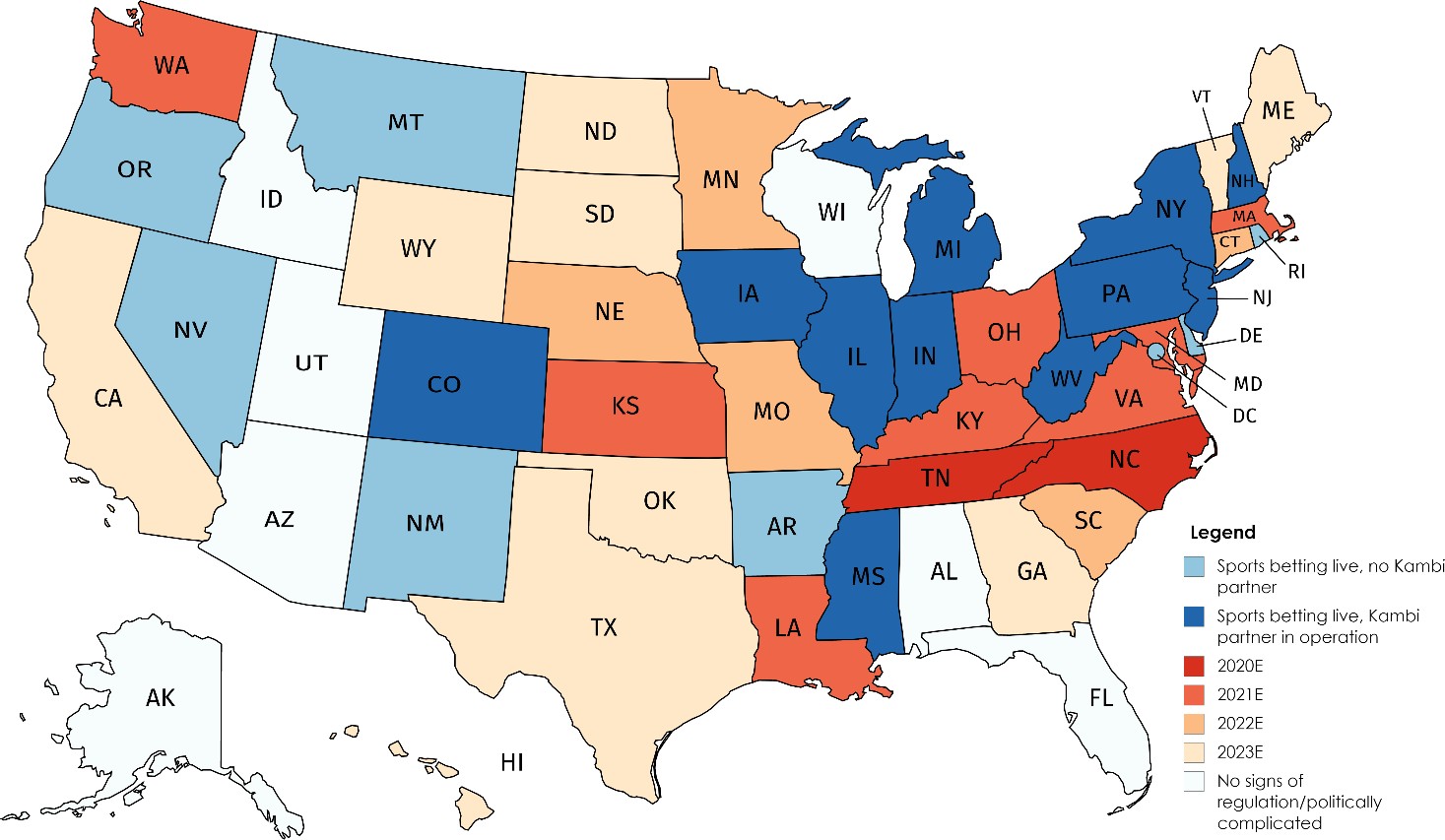

The current regulatory regime is highlighted in Picture 4. Each state varies by its regulatory structure and tax rate. There have been three main approaches amongst regulated states:

1. Open access structure. Each land-based casino can apply for a license to launch sports betting (Pennsylvania, New Jersey, Iowa, Michigan).

2. Limited licensing structure. Only a few casinos selected by the state can run a sportsbook (Delaware, West Virginia, New Mexico, Oregon, North Carolina).

3. The lottery structure. The sportsbook is run by the state itself. For online operations, the states organise a competitive bidding process after which it selects an operator to run sports betting (New Hampshire, Rhode Island, Montana).

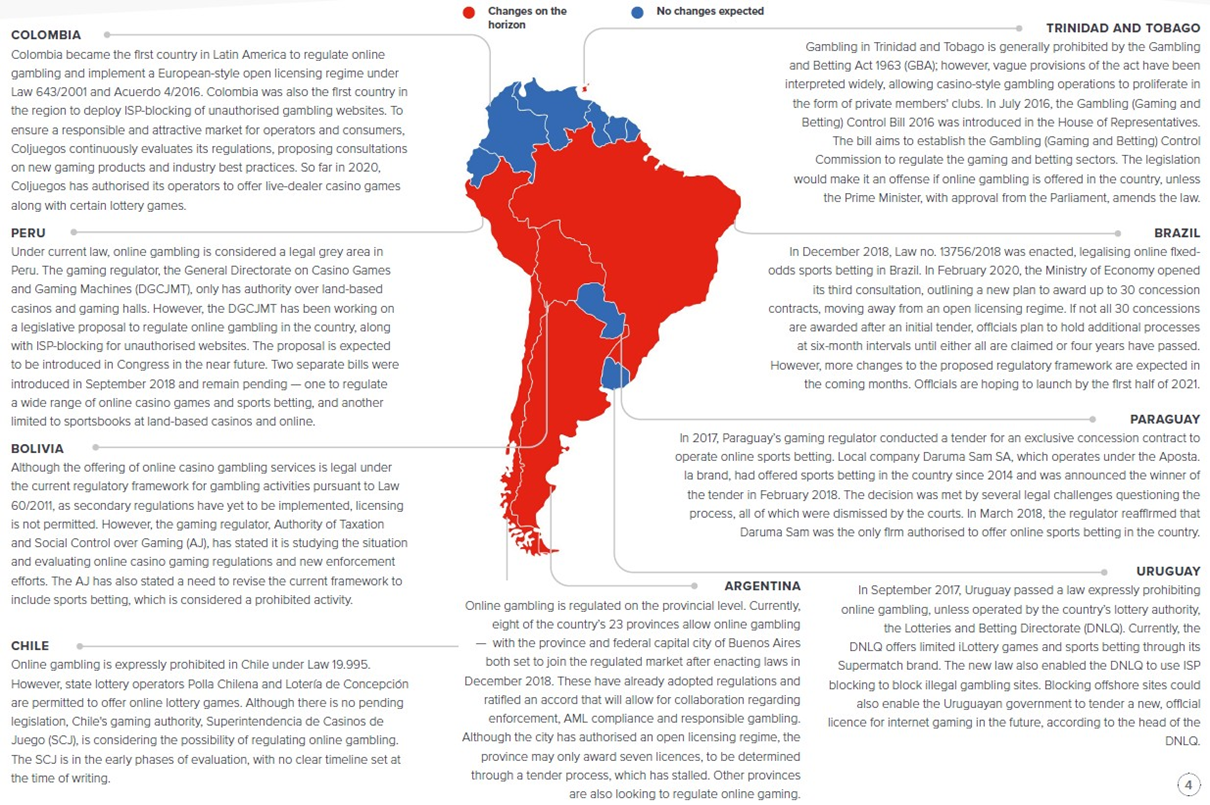

South America’s largest markets are Colombia, Brazil, Argentina and Mexico.

Colombia was one of the first countries in South America to pass laws that allowed for the regulation of online sportsbooks. “Coljuegos reported that its online licensees had registered a total of 1.7m customer accounts (out of a population of 50m), a number that has grown to 2.5m as of this June.”[6]

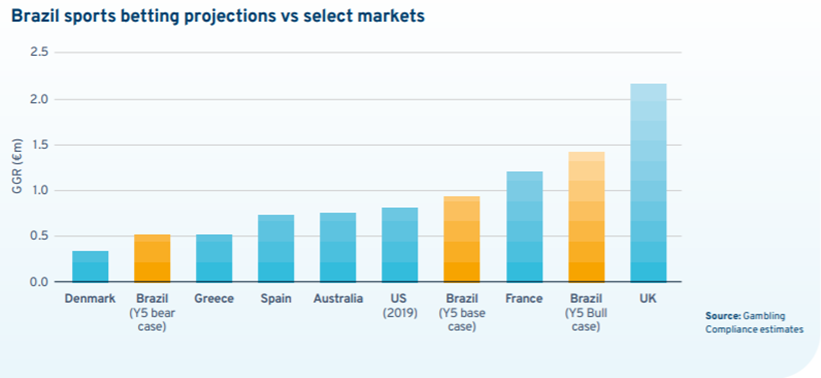

Brazil had been expected to launch this year but is likely now to be 2021, given the ongoing coronavirus pandemic. Gambling Compliance estimates the Brazilian market to be between €0.5M and €1.4m GGR. There is a potential for it to be the second-biggest market in the world. (see Picture 5)

Picture 4[7]

Picture 5

Argentina allows online gaming on a provincial basis but would need to make its national approval more formalised. Overall, the process is not regulated yet. The city of Buenos Aires has approved regulations for online gambling, with a potential market go-live date of Q4 2020. An unlimited number of operating licenses will be available, although operators must have total sales revenue over ARS 100m and have been in business for at least two years. Buenos Aires province together with Buenos Aires City accounts for 40% of Argentinean population.

Mexico is still a grey area, where the market is around $300 million. This implies a huge opportunity once the market is legalised.

Please, refer to Picture 6 for the summary on the regulations in South America.

Picture 6[8]

Picture 6[8]

4. Business Model

Majority of Kambi’s revenue comes from commission-based revenue share of Net Gaming Revenue (NGR)[9] with its operators and minority from fixed and variable fee, which depends on several factors. Kambi’s take rate varies between 10% and 15%. The average contract length is between 3 and 5 years. Kambi’s revenue can be calculated as follows: Revenue = (GGR – marketing incentives) * (1-tax) * (take rate).

Kami provides odds and manages the risk. It buys real-time data from sports events that are going everywhere in the world. This data goes into their system, which is analysed by their algorithms and traders. Kambi uses these analyses to predict the outcome of games and to set the odds pre-match and in-match. It is impossible to get probabilities right every time, so risk management is a core of the process. Kambi interprets new information from new bets, market movements and in-game news and then optimises the price.

5. Customer Value Proposition

Kambi’s customer value proposition is that they take all the heavy lifting from its partners, allowing them to focus on its customers.

CEO of Penn National Gaming highlighted that they rather focus on what they do best and leave the rest to Kambi: “Now does it make sense to go even more vertically sort of back-end and risk management trading services? Maybe. Maybe not. Maybe that’s an area that we say others can just do it better than we can, and so we’d rather not expend energy and resources on that.”

There are four main reasons why operators pick Kambi.

Firstly, Kambi provides its partners with the freedom and flexibility to create its own sportsbook with easy API integration or to use a ready user interface.

As explained by Chief Commercial Office of Kambi: “When you selected Kambi, you are not getting a Kambi app. Kambi provides our partners with the freedom to be who they want to be. They can use our technology and APIs to develop a Penn National app that is unique for the end-user while developing and building their own IP, which adds intrinsic value to the organization.”[10]

Secondly, Kambi provides quick access to the market in a regulated manner. For example, Seneca has signed with Kambi in November and was up and running with Kambi’s Sportsbook in December. Kambi has been the first to take the first legal wager in 8 states.

Thirdly, Kambi leads to more GGR because it offers more in-game bets, provides better user-experience, can work at a larger scale and has better risk management.

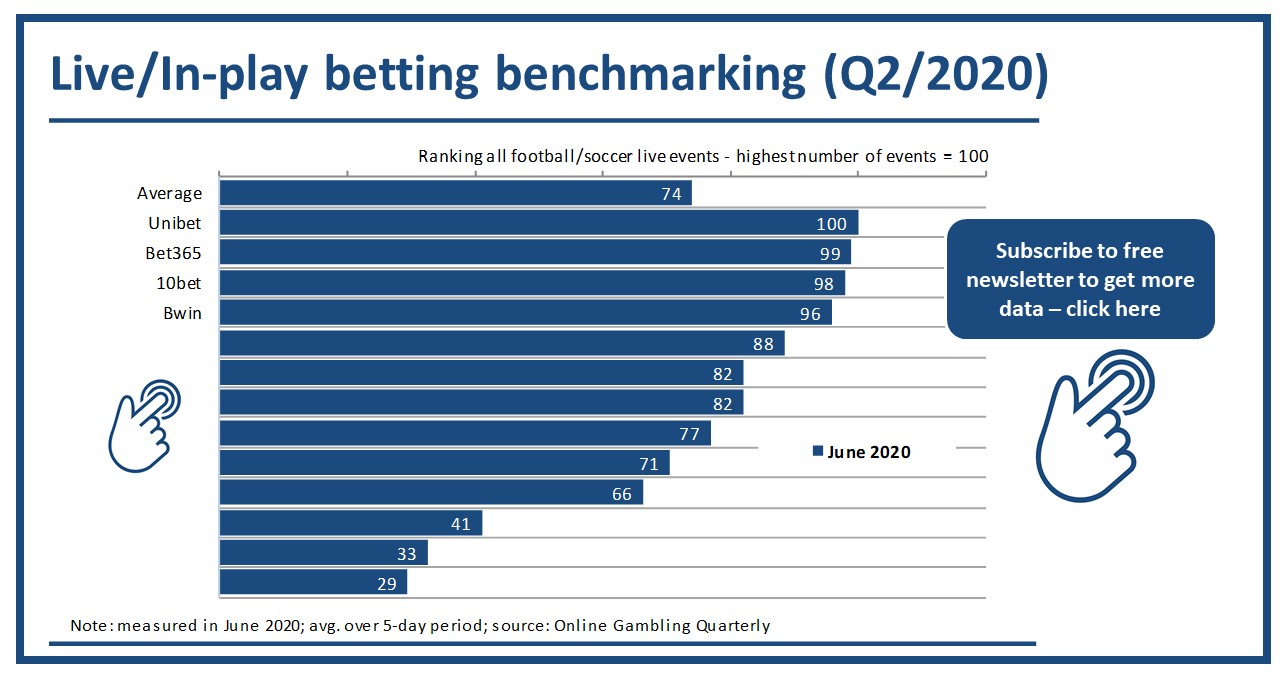

As CEO of Kambi puts it “due to the speed, skill and complexity involved in offering live odds, the quality of an in-play product often separates a good sportsbook from an excellent sportsbook. A few examples of the strides we made last season include significantly improving the availability of the main bet offers in-play. Availability is key. If the markets aren’t available, then end-user can’t bet and, therefore, receive a poor UX. The availability of main markets increased from 60% to 90%, enabling our partners to increase their in-play turnover.”[11] Kambi’s superiority to competitors in terms of in-play betting was confirmed by a Former Director of Kambi, who said that “a great example of that is if you just look at in-play offerings that are available. If you look at Scientific Games or an IGT product or even an SBTech product to some extent, there’s just not as many markets available. You are really wagering pre-match, whereas, with Kambi, most of the bets taken at Kambi are in-play bets versus if you look at MGM or IGT or any of these guys, most of their best are being taken pre-match.” According to Online Gaming Quarterly, Kambi’s client, Unibet, had the highest number of in-play bettings (see Picture 7). This allows Kambi to keep customers longer and give end-customer more opportunities to spend money with the operator.

Picture 7

Kambi also has less delay in terms of updating odds compared to other providers. “[Kambi’s] research shows that if Kambi had applied a similar in-play delay to those used by some of [its] main competitors, approximately 1/3 of the in-play bets would have been rejected due to price changes. As a result of these developments and more, Kambi’s NFL revenues increased significantly during Q4 to the extent where it overtook both the NBA and the English football leagues to become the #1 revenue driver. Kambi’s in-play excellence has been key to this, and [it will] continue to improve the product further ahead of the coming season. And finally, the Super Bowl last weekend attracted more than 3x higher turnover than the World Cup final in 2018.”[12] Moreover, some providers that do in-play have to wait for commercials, while Kambi does not. All this contributes to better user experience.

Kambi focuses on the end-user experience. As Kambi explains at the Capital Market Day 2019, “so from the end-users’ perspective, we believe that we are in the entertainment business. We help our customers to provide a service to our end-users — or not a service but an experience to our end users. And if the end-users do not find that experience compelling, they will easily move to another sportsbook and put their bets there”[13] In the US, people from the industry distinguish between European and Vegas model, where European model focuses on user experience, while Vegas model believes that the best odds attract customers. The European model has developed its product to work in scale and to provide the in-bets offering, which has proved to be more successful and more profitable. In contrast, the American model has lacked these offerings and has been significantly underperforming.

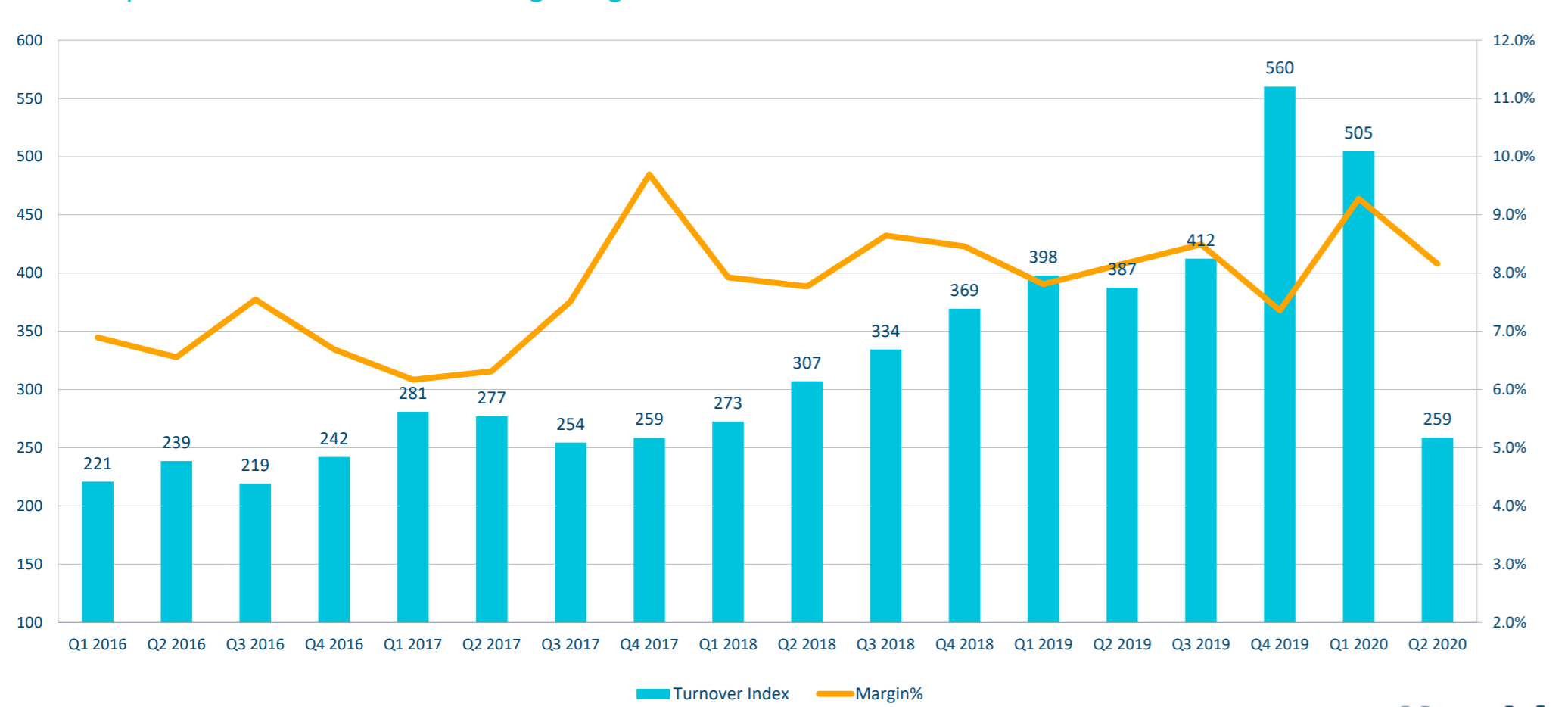

An important part here is providing a good end-user experience while managing the risk. Providing good odds creates more action, and, therefore, more turnover. However, goods odds create an opportunity for sharp bettors, which exposes the company to loses. Kambi’s systems are very good at identifying sharp bettors and adjusting its prices based on their action. The company manages the risk with the assistance of algorithms and traders. Risk management is particularly vital during in-game bets, as the odds might change significantly due to in-game events. Kambi has a team of specialist traders working on each sport. Kambi’s excellence in creating action and managing the risk is evident from its turnover index (see Picture 8). The graph showed the aggregated results of Kambi’s operators. The turnover is the total stakes-placed with the operators by their end-users, and the margin represents the combined trading margin made by the operators. Even though Kambi is more expensive compared to other providers, it is worth it in the long run because of more GGR.

Picture 8

Finally, Kambi provides a great retail offering. It brings the online experience to the retail space. A key component of providing players with a high-quality retail experience is Kambi’s Self-Service Betting Terminals, or kiosks as they are called in the US. Kambi’s kiosks leverage the same core technology stack that drives the online sportsbook, meaning retail players receive the same speed, market depth and in-play offering as players do betting online. Another key part of Kambi’s retail armoury is its Bring Your Own Device (BYOD) technology. BYOD enables players to view betting markets and odds on their mobile and build their bet slips. When bet slips are complete, a QR-code is created which can then be scanned on-property for quick and easy bet placement.

CEO of Kambi, Kristian Nylén, highlighted the success of Kambi in retail:

“If I were to pick an area that exceeded our projections, I would look to the number of people we see coming through our kiosks. Pre-lockdown, approximately 80% of all on-property bets were placed at a kiosk, which in turn reduces the queues for the teller. Our partners have sought to make room for further kiosks in order to meet demand, underlining their importance and popularity. Along with our Bring Your Own Device technology, they have revolutionized the on-property experience”[14]

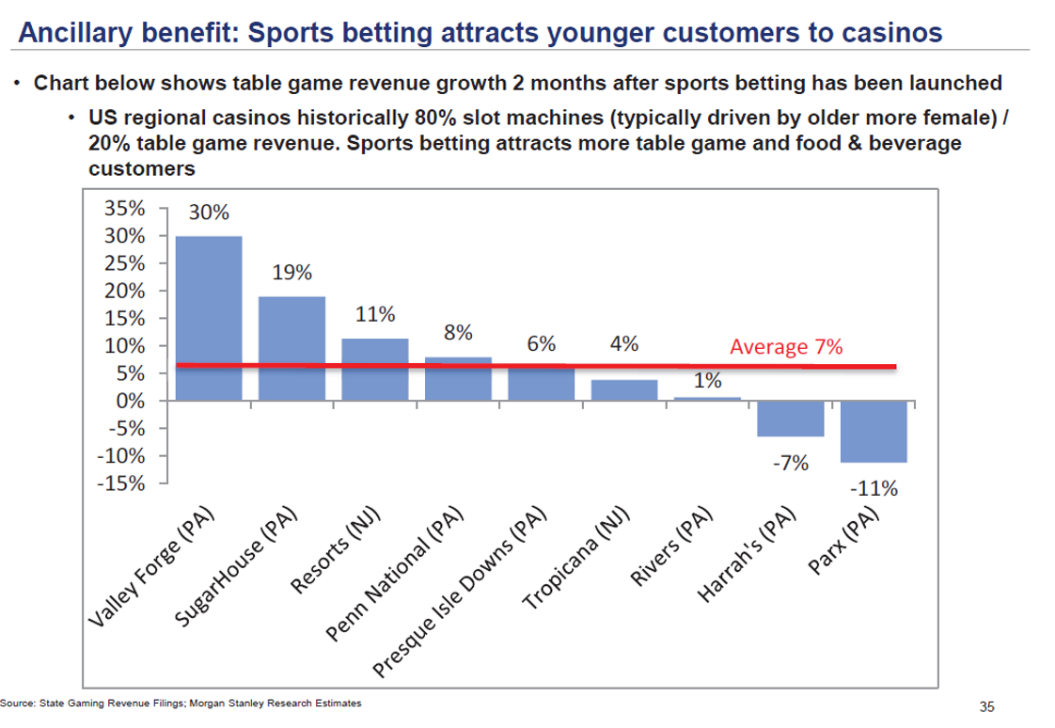

Retail sports betting creates cross-selling opportunities for casinos, as it attracts more table games and food & beverage customers (see Picture 9). Penn National, a client of Kambi, is “very bullish on omnichannel”, and that’s one of the reasons they selected Kambi as its partner.[15]

Picture 9

7. Competition

The only competitor who can provide good service retail and online is SBTech. However, Kambi is far more advanced in terms of its capabilities. SBTech does not create its own odds, but rather scrape prices from other sportsbooks, predominantly from Bet365, and create a weighted market average. This comes with multiple downsides. Sometimes odds provided by other sportsbooks represent a hedge rather than a true probability. Therefore, it is optimal for Bet365 but sub-optimal for SBTech. Since there is no independence behind the odds, there is no integrity behind the risk management. This would be especially evident during in-game bets. This means Kambi leads to higher GGR than SBTech, and Kambi is pretty much the only provider who has this trading autonomy.

Moreover, SBTech has been recently acquired by DraftKings. While it is still not confirmed, SBTech will probably continue to operate as a B2B supplier. This means SBTech is losing its independence through the DraftKings deal. SBTech’s direction in terms of markets and product will be focused on the benefit of DraftKings rather than all operators. Moreover, sportsbook suppliers have access to a lot of operator’s data, which companies may not want to share with a technology company owned by a competitor. That’s something Kambi’s experienced first-hand until the company spun off from Kindred in 2014. It was not until Kambi was an independent company that it was able to gain the complete trust of operators. Another similar example is William Hill, which was a very successful B2B. However, when William Hill got bigger, its customers (MGM, Caesars and the Wynn) moved away from the company in late 2014-15. This is because they realised that they are subsidising William Hills’ tech and giving it more money for its B2C business. William Hill can spend money from them on developing improvements that benefit its customer and on its customer acquisition to compete against them. As a result, other sportsbooks may be less willing to use SBTech as a supplier and existing operators could switch. Interestingly, one of the SBTech’s clients, BetAmerica, a subsidiary of Churchill Downs, has recently decided to switch providers and signed a new deal with Kambi.

Two biggest competitors despite SBTech are IGT and Scientific Games. Kambi has superior sportsbooks, however, these competitors provide a bundle sportsbook with slots, casino integrations and casino management. At the same time, these competitors are substantially cheaper than Kambi. A casino’s decision on the providers depends on its objective. If the operator wants to compete with DraftKings and FanDuel and capture a meaningful market share, it goes with the best-in-class product – Kambi. However, if it just looking to have a sportsbook offering as a pleasant addition, it goes with IGT or Scientific Games.

Other small competitors are BetConstruct, GiG, Don Best and Bet.Works. They have a worse offering, almost no big clients and not enough liquidity to execute.

There are also competitors that have their in-house sportsbook, and they provide B2B offering. The disadvantage of this was already discussed previously, and it seems that they are unlikely to take any meaningful market share. Some examples of them are William Hill, GVC and Betsson.

8. Competitive advantage

Kambi will be able to maintain its leadership because of (5.1) high barriers to entry, (5.2) high switching costs and (5.3) economies of scale.

8.1 High Barriers to Entry

It is extremely hard for a new entrant to enter the market because of required high financial and human capital investments in the market with a limited talent pool, the time it takes to for algorithms to learn delivering good trading margin and high regulatory burden.

To rebuild the platform from scratch, a company would have first to pay hundreds of millions of dollars to build the platform and then it would have to pay additional costs to maintain it. These additional costs include salaries for plenty of traders and operation teams and R&D investments. For Kambi, it takes around €70m – €80m in operating expenses to support the platform. Finding people to build this algorithm is very difficult. This struggle was well-explained by a Director of Digital Sportsbook at DraftKings:

When you build a platform, you need domain knowledge. So you could have the greatest technologies on the planet, but if they don’t understand the domain that you’re operating in, then they’re not going to build something that’s going to work efficiently and effectively in your industry…. The type of people who can do that type work, there’s not a huge amount of them globally.

So, it will take considerable time to find people who can build the algorithms, and it should take around 1-2 years to build it. There were providers, such as PokerStars and MoPlay, who tried to build the platform from scratch and failed, which demonstrates that it is not an easy thing to do.

After building the algorithms, a provider would need to get approval from each state or country in which they want to operate and get itself compliant with different rules and regulations of the jurisdiction of interest. This significantly delays time to market, which is particularly important at the moment since newcomers have a better opportunity to capture market share in newly legalised states and countries. A good example of how critical it is to get quick access to the market is the fact that William Hill partnered with Kambi in Sweden after the country changed its regulations, despite the fact that William Hill has its own back-end.[16] Kambi operates only in regulated markets, which makes it easier to get new approvals. It has successfully obtained all licenses it has applied for.

The new-build algorithm would be not as profitable as Kambi’s one from the beginning. It would require multiple years to improve it to catch up and deliver similar trading margin and turnover. This well highlighted by Director of Digital Sportsbook at DraftKings:

The first time I run an algorithm on an individual sport, I might do really, really well to extract 4% margin from that algorithm. In a years’ time, I will have improved that algorithm to, I’m now getting 4,5%. Another year after that I am refining it again, I am now up to 5.5%.

At the moment, Kambi’s margins are between 7% to 10%, which means that it would take a considerable amount of time to get as good as Kambi.

Moreover, from front-end providers perspective, building a new platform will distract them from focusing on customer acquisition and result in capturing less market share, which is especially important when the industry is in its infancy in the US.

8.2 High Switching Costs

Back-end platform migration is a complex process, which is a massive drain on manpower, resources and operational momentum. Every back-end platform is unique in the way it operates. If a company wants the same functionality as in the previous platform, it will have to develop it to match it. There is also the challenge of migrating a mountain of data that might not be compatible between the two platforms. That includes pricing histories and customer intelligence, which is needed for bonusing and trading decisions.

At the same time, migration is putting the entire business on hold. The company has to spend all its development resources building things it already had. The migration period takes around a year. For a front-end operator, this takes away its focus from doing business and customer acquisition. Both Paddy Power Betfair and bwin.party had lost market share and experienced declining revenue growth during the time of migration.

After successful migration, the company has to retrain the engineers and the traders on the floor, which takes a massive training budget.

8.3 Economies of Scale

Kambi’s scale allows it to better manage risk, offer more lines in more situations, provide lines on niche sports and invest more money in R&D. This helps them to generate more GGR.

Firstly, operating at a scale allows Kambi to have more data based on which Kambi’s algorithms and traders can identify mispricing quicker and adjust their lines.

Secondly, Kambi offers more lines in more situations and adjust their odds for new information quicker because they have a separate trading team and tech team for every sport.

Thirdly, having a scale allows Kambi to provide lines for niche sports. Bigger offering attracts a wider group of people and results in more profit. For a small operator, it is not worth hiring a trader a niche sport, since it will never be able even to compensate for his salary.

Finally, generating more revenue allows Kambi to invest more money in R&D and, consequently, improve its offering.

9. Main Drivers of Value Creation

9.1 Expansion and Legalisation in North America

Kambi will be able to capitalise on the legalisation of sports betting in North America. Estimates for the US market at maturity varies between €12bn and €20bn GGR. Assuming a 15% tax rate and 11% take rate implies €1.1bn TAM for Kambi, based on the lowest market estimate. As of 2020 Q1 LTM, Kambi generates only ~€24m revenue from North America (assuming 90% of revenue coming from North America out of reported Americas revenue). At 15% market share, this implies at least ~€140m opportunity for Kambi. 15% market share is very realistic, since the current market share of Kambi is ~32% or ~14%, excluding DraftKings (DraftKings will leave Kambi by the end of Q3 2021). This means that Kambi has an opportunity to increase its revenue at least ~2.5x.

Moreover, there are strong indicators that Kambi will have much more than 15% market share in the US at maturity. One of Kambi’s client, Penn National (PENN), is inflecting growth in sports betting. PENN has been guiding 8% – 19% market share in sports betting and iCasino at maturity.[17] Goldman Sachs projected that PENN is expected to capture 15% market share in online sports betting by 2030. PENN sports betting will benefit from a recent investment in Barstool. The deal allows PENN to utilise Barstool’s brand for retail and online sports betting and iCasino products. PENN has launched a PENN/Barstool app for sports betting at the end of September. It is already the number one sports betting app in the US. Barstool Sportsbook already 30,000 app downloads and 24,000 registrations in PA, average deposit size of $243 and $11 million in total handle. Barstool will leverage its key talent, live events and tailored content to promote PENN. At the same time, PENN retains 100% of all revenue from sports betting and iCasino. Barstool is a sports and pop culture blog with 66mn unique users. It has 14.7mn monthly unique on its web & app, 38.5mn followers on Instagram, 18.2mn followers on Twitter, 9.2mn podcast listeners and 5.1mn on TikTok. To put it in perspective, DraftKings and FanDuel have only 0.1mm Instagram follower and 0.3mm Twitter followers. From the company’s 66mn monthly unique visitors, the company has disclosed that 62% bet on sports with 44% of those betting at least 1x per week.[18] This means that there are around 18mn of users actively bet on sports. Assuming 10% conversation rate and $300 GGR per playing user, this implies $540mn (~€450) opportunity for PENN from sports betting. At 10% take rate and 14% tax rate, this is ~€40m opportunity for Kambi.

Another client of Kambi, Rush Street, has been guiding 6%-10% in online sports betting in its IPO/SPAC presentation. Meanwhile, Unibet (Kindred) already has a 4% market share in online sports betting in New Jersey. Kambi also recently signed BetAmerica.

There is also a big opportunity in terms of tribal casinos. Tribal casinos operate on Indian reservations or other tribal lands. They have tribal sovereignty, which means states have limited ability to forbid gaming on their land. There are 524 tribal casinos in the US[19] with around $34bn annual turnover.[20] Kambi has already signed 4 tribal casinos. As Kristian Nylen, Kambi’s CEO noted:

“Kambi has established itself as the trusted partner to Tribal casino gaming enterprises that wish to leverage the strength of their brand to truly capitalize on the sports betting opportunity, and we are excited to be supporting Four Winds as they look to fulfil their online and on-property ambitions,”

Therefore, Kambi is well-positioned to have at least ~20% market share and potentially more.

9.2 Operating Leverage

Growing further, the company will experience benefits from operating leverage. Most of Kambi’s costs are fixed and it requires a very little incremental cost to add a new customer. A variable cost of the business is the trading team. However, Kambi’s offering is already at its maturity, and it already has enough traders to cover in-sports betting and multiple sports. As of 2020 Q1 LTM, Kambi EBITDA margin was around ~39%, while incremental margins have been ~70%. Another cost which is not reflected in EBITDA is development expense. It is currently ~16% of revenue 2020 1Q LTM and is expected to decrease, as the company matures.

9.3 Expansion and Legalisation in Latin America

Kambi is well-positioned to capitalise on an opportunity in Latin America when additional territories enact regulatory frameworks because of its regulatory expertise and quality of the product. Kambi has already been successful in Colombia.

Kambi’s success in Colombia has significantly raised its profile in the region, giving the company a springboard into other markets. Kambi signed with Corredor Empresarial in June 2017, to power the operator’s BetPlay brand. Through the partnership, BetPlay has become the leader in the market. Another Kmabi’s operator, Rush Street, has secured a top-three position in the competitive market. Kambi has a partnership in Mexico with Grupo Televisa, where Kambi provides sports betting services to 18 PlayCity casinos. Since Kambi already had a good experience in emerging markets, they should have no problem to capitalise on legalisation in Latin America. This is not a part of my thesis, but a nice option.

10. Catalysts

My thesis does not require a catalyst. Kambi will compound over time by growing its revenue and increasing its margin. Nevertheless, there are two potential catalysts in the medium to long term future.

Firstly, Kambi might re-list in the US. iGaming and sports betting companies trade at much higher multiples compared to Europe. For instance, DraftKings and GAN trade at 38x EV/Sales (negative EBITDA) and at 59x EV/EBTIDA 14x EV/Sales respectively (based on FY19). At the same time, Kambi with a better margin profile and similar growth trades at 7.2x EV/Sales 2020 1Q LTM and 21x EV/EBITDA 2020 1Q LTM.

GAN experienced significant re-rating after transferring its listing from the UK to the US. This is probably related to the fact that Europe is very concerned with ESG, while the US does not have it as a priority. Moreover, Kambi is not well-known in the US investor community. Therefore, re-listing will bring awareness about the company and will likely re-rate at a higher multiple. At the moment, re-listing is not management’s priority, since it is focusing on expanding in the US.

Secondly, Kambi is a potential acquisition target for PENN. As PENN grows its sports betting offering in the US, it would make sense to acquire Kambi similar to the way DraftKings has acquired SBTech. It would not be possible in the short term because of the poison pill from Kindred in the form of convertible debt. According to the terms of the convertible bond, the company is obliged to procure that certain events listed in the agreement do not take place, unless with the prior consent of the lender. In case of a conversion, Kindred would obtain a controlling influence over Kambi, consequently having the power to control the outcome of most matters to be decided by vote at a shareholders’ meeting. However, the agreement is until 2023, after which Kambi can be acquired by PENN.

11. Management

CEO (Kristian Nylén), Deputy CEO (Erik Lögdberg), COO (Jonas Jansson) and CFO (David Kenyon) have worked at Kambi since its formation in 2010.

The interest of management and shareholders is aligned. Management has significant insider ownership and their bonuses are tied to EBIT and customer signings. CEO owns 1.5% of the company, which is around €10m (more than 10x higher than his salary of €891m).

The management is shareholder-friendly and focuses on the long-term performance of the business. During Capital Market Day 2019, Kambi said that:

“On top of what I’ve talked before, which is naturally also important for our shareholders, is to have a return on their investments. And one of the absolutely most important task for us, as the management team, is to have a very stringent and sophisticated approach to our capital and resource allocation with the ambition of securing a high return on investments for our shareholders.”

One example of their shareholder-friendly culture is the fact that they opened their US office in Philadelphia rather than New York. Phil Richards, the US General Manager at Kambi, also said that this gave them a strategic location to two key market – New Jersey and Pennsylvania – and good access to talent from nearby universities.[21]

On the Capital Market Day 2019, Kambi also explained how they focus on long term performance:

“We set our long-term strategy on the 3 years horizon. We break that down to company performance target on a yearly basis, which in turn gets broken down into quarterly key objectives. And that gets actually broken down to departmental and team level within the company. And in that way, we’re really having the connection between what we want to achieve as a company and what is expected from each and every one of the employees. It’s a very, very solid and thought-through process. And we, as the management, we monitor this on a monthly basis how the progress is and where we are.”

A former director of Kambi said: “I don’t think Kambi is necessarily concerned with the share price as other companies may be. It goes back to where this is kind of the brainchild of very few individuals where they’re running into the race because they want to run the race.” I view this a very positive and it seems that Kambi has strong management with a long-term view.

12. Culture

The culture in Kambi is top-down. All the decision making is extremely centralised. While there are successful companies with a similar decision-making process – for instance, Facebook and Amazon – I view this as a negative. According to a Former Director of Kambi, it is hard to offer new ideas to the company whether you are working in the company, shareholder or board member. Kambi lacks delegation and sharing of responsibilities. A former Content Manager of Kambi expressed similar issues and said that there is a need for more freedom for the departments to adopt and bring new services and freedom for other C-level. This kind of structure makes the company more fragile, more bureaucratic and less innovative. Other negative aspects of culture collected from Glassdoor are that things do not get done, slow decision making, lack of development opportunities and poor salary.

On the positive side, it seems that these negative aspects get better. Negative reviews on Glassdoor were made a couple of years ago and interviewed people worked also at this period of time. Glassdoor has many recent positive reviews, highlighting good culture, flat hierarchy and great work-life balance.[22] Phil Richards, the US General Manager at Kambi, says that Kambi focuses on recruiting people who are passionate about sports, which is also a positive sign.[23]

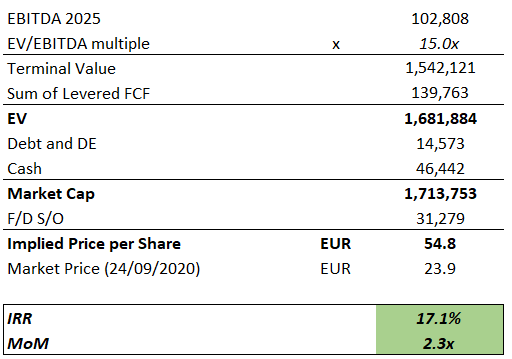

13. Valuation

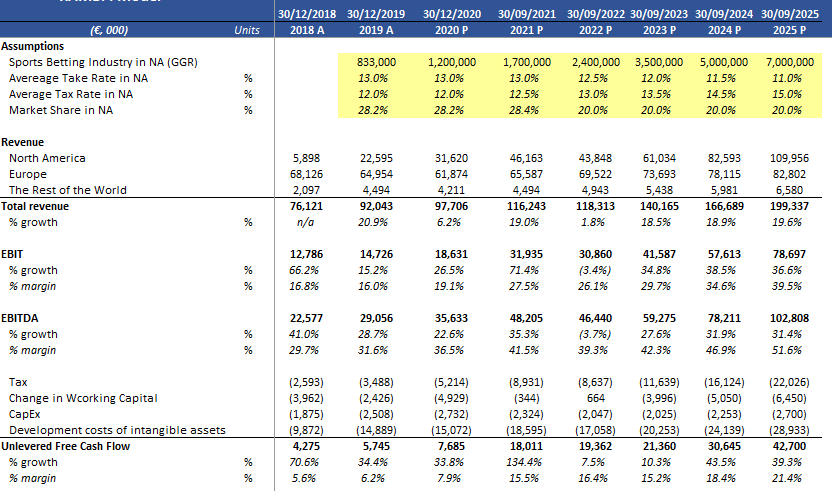

I value Kambi based on its potential IRR, which I expect to be at least between 14% and 20% over the 5-year period. My forecast does not include potential revenue from South America and potential multiple re-rating, so there can be even more upside. Indeed, I value Kambi based on its lowest historical EV/EBITDA in the last five years, while companies in the industry trade at much higher valuations. My tax rate assumption is 28%. The purpose of this valuation is not to precisely get Kambi’s revenue and margins, but rather to see how much revenue and margin expansion it needs to provide a meaningful upside. Please refer to Picture 10 for the summary of my forecast.

Revenue from North America FY19 was €22.6mm (assuming 90% of Americas revenue came from NA) and is projected to grow to €110mm by 2025. I project Kambi’s revenue NA revenue based on Morgan Stanley sports betting industry estimates, which expects the industry to be ~€6mm by 2025. While Kambi does not report GGR or NGR, it is possible to arrive at a reasonable estimate. The take rate of Kambi is between 10% and 15% and average sports betting tax rate in NA is around 13%. Assuming 13% take rate and 13% tax rate, I estimate Kambi’s 1Q 2020 market share to be around ~32% or ~14% excluding DraftKings. DraftKings acquired SBTech and will completely leave Kambi by the end of Q3 2021. I project that revenue from NA will drop to 19% market share in 4Q 2021 and will grow to 20% by the end of FY25. This should be reasonable and conservative estimation considering the current market share of Kambi and recently singed clients, such as PENN and BetAmerica. These clients combined are expected to exceed the current market share of Kambi. Going forward, I estimate that the NA average tax rate will increase to 15% and Kambi’s take rate will decrease to 11% by FY25. This is because of the legalisation of more conservative states and because PENN will grow as a percentage of revenue for Kambi.

Revenue from Europe FY19 was €65mm and is projected to grow to €83mm by 2025. This projection is based on an estimated sports betting market growth in Europe of 6%. Moreover, this includes Kambi’s loss of 888’s revenue from UK and dot.com by the end of 2020. 888’s revenue from the UK equates to ~55% of its revenue or €42mm. Assuming a 21% tax rate and 13% take rate, this is €4.3mm loss for Kambi.

Revenue from the Rest of the World (South America and Other) were €4.4m, and I project them to grow by 10% to €6.6m by the end of FY25. As I mentioned, this is not a focus of my thesis, and I view this as an option.

Kambi is also expected to lose the rest of the revenue from 888’s sports betting business. There is not enough information to sperate it by region, so I am subtracting its revenue from the final revenue. I expect 888 to leave at the beginning of FY21. As of FY19, 888 had ~€34m revenue from sports betting, excluding UK and dot.com regions. Assuming 18% tax rate and 13% take rate, Kambi had €3.7m revenue from 888 in FY19. 888 should have higher revenue sports betting revenue in FY21 due to legalisation of NA. I project it to be €4.1m in FY21 and grow by 12% to €6.5m by the end for FY25, in line with historical growth.

Combining all geographies results in €92m FY19 growing to €193m by the end of FY25 (~16% CAGR).

In terms of EBITDA margin, I project a 70% incremental margin expansion, which takes us from €68m in FY19 to €103m in FY25. This in line with management estimation of the increase in operating expenses by 3%-5% every quarter.

Other costs not reflected in EBITDA are CapEx and development costs. I estimate that they will decrease, as the business scales and becomes more mature. I project CapEx to go down from 2.7% in FY19 to 1.4% in FY25 and development costs to decrease from 16% in FY19 to 15% in FY25.

Picture 10

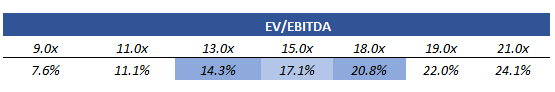

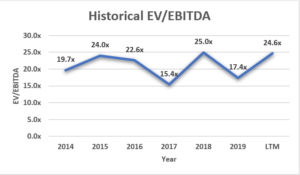

For the exit multiple, I use 15x EV/EBITDA, which results in the implied price of €55 in FY25 or 17% IRR (see Picture 11). In the last 6 years, Kambi has been trading between 15x and 25x EV/EBTIDA (see Picture 12). As of now, it trades around 21x EV/EBITDA or 7x EV/Sales, based on Q1 2020 LTM numbers. Meanwhile, other companies in the industry, such as DraftKings and GAN trade at 38x EV/Sales (negative EBITDA) and at 59x EV/EBTIDA 14x EV/Sales respectively (based on FY19). These companies are different in their own way from Kambi and cannot be used as an apple to apple comparison. However, their valuations are significantly higher. Therefore, I think that my 15x EV/EBITDA is very conservative, and there is a lot of margin of safety.

Picture 11

Picture 12

Obviously, the real world will not be as smooth as the model. The market share, tax rates and GGR will be volatile. Nevertheless, I believe that the stock has a reasonable margin of safety at the current price. Even if Kambi does not exceed its current market share of 14%, it still should almost double in 5 years’ time (12% IRR). Furthermore, my multiple is conservative.

14. Risks and Mitigants

14.1 Regulations

There are three main concerns in terms of regulations. Firstly, states or countries can delay the legalisation of sports betting or governments can outlaw sports betting in certain jurisdictions. Secondly, more states can adopt lottery or limited licensing structure types of regulations. Finally, states or countries can increase tax rates.

14.2 Consolidation

Two biggest B2C sports betting companies are DraftKings and FanDuel, and they are both not clients of Kambi. If they capture the majority of the market, there will be little left for Kambi operators.

There still should be enough space for Kambi, taking into account its growing clients, such as PENN, Rush Interactive and Unibet, and opportunity in terms of tribal casinos.

14.3 Customers Leaving Kambi After Achieving Certain Scale

As B2C operators grow, they become less willing to give 10% – 15% of their revenue to Kambi. While they are part of Kambi, they observe how Kambi operates, reach scale and then they might try to imitate it by acquiring another sportsbook or building their own. A recent example of this is DraftKings, which is leaving Kambi after acquiring SBTech. A next company that probably will leave Kambi is 888 Sport. 888 Sport has acquired BetBright’s sports betting technology platform. 888’s BetBright release didn’t mention Kambi, but 888 did say that it would begin the technology integration process as “soon as practically feasible” and would begin a “phased and market-by-market roll out” of its new proprietary betting product once that integration is complete.[24] Players in the UK market will migrate by end of the year to 888 Sports platform. In a similar manner, Penn might leave Kambi at some point in the future.

It is risky to migrate from one platform to another as it shifts focus from customer acquisition and as synergies between front-end and back-end are very small. The end result of DraftKings migration will be a good demonstration of how easy it is to switch the platform and how beneficial it is.

14.4 Integrity Fee

Integrity fee is taxes on legal sports betting, which go to professional sports leagues on the basis that it will go towards protecting the integrity of the sport. None of the states that have passed sports betting laws has included integrity fees payable to sports entities.

Integrity fees are unlikely to be introduced, as it takes money away from state revenue and the argument for introducing them is weak since the leagues are playing no functional role in the sports betting industry.[25]

14.5 Kindred as the Biggest Customer

There are two problems with it. Firstly, Kindred is around 45% of Kambi’s revenue in 2019. If Kindred leaves, Kambi will lose a substantial part of revenue. Secondly, Kambi’s decisions in terms of building new features and opening new markets could be directed towards benefiting Kindred rather than all operators.

Kindred has a strong corporate and personal relationship with Kambi and a shared owner (Anders Ström). Therefore, it is unlikely to leave. Kambi is signing a lot of new clients, which will diversify its revenue in the future. Kindred’s share of revenue already went down to ~45% in 2019 compared to ~69% in 2018.

14.6 COVID

COVID postponed or cancelled many matches and competitions. As fewer matches and competitions mean fewer sports betting, a continuation of COVID will impact Kambi’s revenue.

- 4Q 2019 Presentation ↑

- 2020 Kambi Annual Report ↑

- ibid ↑

- https://sportsbettingoperator.com/news/sports-betting-market-estimates-growth-by-2025-between-7b-to-8b/ ↑

- DraftKings Earnings Presentation 2019 ↑

- https://calvinayre.com/2019/08/01/business/colombia-online-gambling-grows-63-percent/ ↑

- Niclas Juslin, Kambi Write Up ↑

- Vixio ↑

- NGR is Gross Gaming Revenue (GGR) less marketing incentives and taxes. GGR is amount wagered less winning pay-outs. ↑

- https://www.kambi.com/industry-insights/play-usa-choosing-kambi-penn-national-will-own-its-own-destiny ↑

- Kambi Earnings Call 2019 ↑

- ibid ↑

- Kambi Capital Markets Day 2019 ↑

- An interview between CEO Kristian Nylén and Betting USA 26th June 2020 ↑

- https://www.kambi.com/industry-insights/play-usa-choosing-kambi-penn-national-will-own-its-own-destiny ↑

- https://www.kambi.com/kambi-group-plc-provide-sportsbook-william-hill-sweden ↑

- Penn National, “Omni-Channel Growth Strategy Update” (14 May 2020) ↑

- Penn National, “Penn National Gaming – Barstool Sports Investor Presentation” (29 Jan 2020) ↑

- https://www.statista.com/statistics/188004/number-of-us-tribal-casinos-since-2005/ ↑

- https://www.topuscasinos.com/news/tribal-casino-revenue-increased-4-1-in-2018-to-set-record#:~:text=12%2C%20the%20National%20Indian%20Gaming,over%20the%202017%20fiscal%20year. ↑

- Podcast Growing Greater, Kambi: Phil Ricahrds ↑

- https://www.glassdoor.co.uk/Reviews/Kambi-Reviews-E575813.htm ↑

- Podcast Growing Greater, Kambi: Phil Ricahrds ↑

- https://calvinayre.com/2019/03/04/business/888-betbright-sports-betting-platform-deal/ ↑

- https://www.legalsportsreport.com/integrity-fee/#:~:text=What%20is%20a%20sports%20betting,sports%20betting%20in%20the%20US. ↑