I have not posted any ideas for a while. This is because I have started working as an analyst at Anker Capital, and I am only allowed to post ideas on which I work in my free time. Nevertheless, I will still try to post one idea every two-three months or maybe I will start writing shorter investment write ups. This is the highest conviction idea in my portfolio at the momemnt. Download a pdf for a better formatted version.

Disclamer: I have a position in this security at the time of posting and may trade in and out of this position without informing. This idea is not investment advice.

Investment Thesis: LONG Intellicheck (IDN LN Equity)

Executive Summary

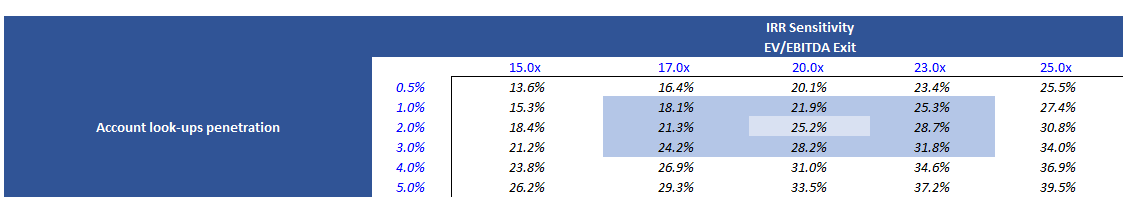

Intellicheck is an offline and online identity authentication software company. It is the only company that can authenticate the documents with close to 99% accuracy rates at a price substantially cheaper than other identity verification competitors. This advantage is protected by its long-standing relationships with government entities, structurally cheaper product and its knowledge of information encoded in barcodes on driving licenses. The company has signed 5 out of 10 big banks and can grow its revenue 11 times just by continuing penetrating these banks’ retail customers with only one of the use cases. The opportunity is multiples of that, considering upselling of new use cases, signing new banks and expanding into new verticals. I expect the company to grow revenue at around 40% CAGR over the next 5 years. Intellicheck has very a scalable product with gross margins of ~90%. The company has strong operating leverage and is at an inflexion point to become profitable. Intellicheck can get to 52% EBITDA margin by 2025. A new CEO has skin in the game and has shown excellent execution over the last couple of years. At 20x EV/EBITDA or 10x EV/Sales exit, this is at least a 25% IRR opportunity over the next 5 years.

Table of Contents

3. Customer Value Proposition 3

4. Competitive Advantages and Competition 4

6.1.1. Cross-selling, Signing New Clients and Up-selling 7

6.1.3. Expansion into new markets and Optionality 9

10.4. Adoption of Chips for Driving Licenses 13

10.5. DMV give access to competitors or stops working with IDN 13

10.6. New Technologies from Competitors 13

10.7. Shrinking TAM in Offline Retail 13

Key Metrics

Stock Symbol: IDN

Stock Price: $9.7 (23/12/2020)

F/D S/O: 19.17m

Market Cap: $186m

EV: $174m

52 Week Range: $1.91 – $10.77

Free Float: 16m

Average Daily Volume: 0.08m

EV/Sales: 16.5x

EV/EBITDA: negative

Business Model

Intellicheck is an offline and online identity authentication software company, which addresses fraud prevention and law enforcement identification. Its solution scans a 2-D barcode on a driving license or non-driver identification card and decodes it to determine whether it is real. The identification cards are issued with mostly the same data as found on a driver license. Intellicheck in most cases charges a fee per scan ($0.2 – $0.4 per scan based on my research) with minimums built into it. For clients with a small number of scans but high-value items, Intellicheck charges per location. Intellicheck provides OCR and facial recognition in partnership with Ipsidy and Applied Recognition. The company also provides scanning equipment if required, but does it as a courtesy rather than the main line of business.

The main clients of Intellicheck are banks and retailers. Others are Federal and Local Law enforcement, transportation hubs, shops, bars, restaurants, hospitals, jewellers and auto dealerships. While the company does not disclose its clients for NDA reasons, it has already signed 5 out of 10 biggest American banks and some major retailers. From my research, I believe some of its banking clients are American Express, Citibank, Wells Fargo, Capital One and some of the retailers are Best Buy, TJ Maxx and Marcy’s.

In terms of Intellicheck’s product use cases, banks use them for opening new bank accounts, loan applications, large withdrawals, online critical changes to the account or large transfers of money and for their call centres. Retailers use them for private label credit card (PLCC) account openings, purchases when a consumer forgot a credit card but have a license, non-receipted returns, buy online and pick up in-store and new branded loyalty credit cards. Businesses that sell age-restricted products and law enforcements use it for age verification. Some military intelligence uses it for identity verification, but this business is a very small part of revenue and eventually going away. Other military providers won the contract.

The main use cases are PLCC account openings, card not present, non-receipted returns and buy online, pickup in-store.

PLCC is a store-branded credit card, which is a type of revolving credit plan managed by a bank. In this case, most of the time banks bear most or all of the loss for fraud. Therefore, banks are charged per scan in this case.

Card not present includes online solution and account lookup in store. In 2019, card not present fraud accounted for 75% of all card-related fraud.[1] Online solutions are used in call centres and online operations. The online solution involves barcode authentication, OCR and facial recognition. Account look-ups is when a consumer forgot her credit card and wanted to charge the purchase against it. Retailers most of the time bear the loss for fraud on card not present transactions. Hence, they pay per scan in this case.

For non-receipted returns and buy online, pickup in-store, retailers bear the loss for fraud and pay Intellicheck.

Customer Value Proposition

The main value proposition of Intellicheck is that its product is the best and only authentication on the market with 95% to 99% accuracy. It provides very strong ROI, it is substantially cheaper than competitors, it is omnichannel and it is easy to install and use without a need for additional equipment.

Fraud amounts to substantial losses to banks and retailers. In terms of loses, identity theft amounts to $16.9bn, chargebacks to $17bn and synthetic identity theft to $6bn – $8bn.[2]

Every time a bank gives or lends money to a fraudster, it loses money. From my channel checks, banks get something around 10:1 ROI; for every million spent, the bank saves at least 10 million. This assessment was done a couple of years ago, and, since then, the fraud has increased, so the ROI has increased as well. The ROI in some cases can be even higher. For example, ROI on credit applications is around 40:1. 0.6% of scans for credit applications are fraudulent and average credit is $2000. This means the bank saves $12 per application, while the cost per scan is around $0.2 – $0.4. Banks can also get reputational damage if they do not prevent fraud. Moreover, banks have an incentive to push Intellicheck to its retailers because they usually bear the loss for most or all of the fraud for PLCC account openings. Retailers benefit as banks provide them with better rates and as they prevent associations of their brand with fraud. There are also use cases which can save money for retailers. As Intellicheck works with the same equipment as retailers use for barcode scanning, retailers do not need to make extra investments.

While bars, shops, universities and clubs do not have a legal requirement to authenticate IDs, it is the socially responsible thing to do, which is especially important for universities. Moreover, bars can lose their license because of police raids. On the police side, they use Intellicheck to know that they are dealing with the right person and for bar raids.

Auto dealers use Intellicheck for two reasons. Firstly, to determine whether the person is real in order to not give a loan to the wrong person. Secondly, to avoid people giving false credentials, going for a test ride and never coming back.

Competitive Advantages and Competition

Intellicheck does not have competitors in the authentication space. It is the only company that can authenticate the driving licenses in the US. It can do it because it has all barcode formats, the digital signatures (licenses have a varied digital signature in them to show that they are authentic) and database of fake barcodes.

Intellicheck obtained this information from its 20 years of relationships with the American Association of Motor Vehicle Administrators (AAMVA) and Departments of Motor Vehicles (DMVs). AAMVA facilitates communication and fosters standardisation among states concerning traffic safety, titling of motor vehicles and licensing drivers. It is also an umbrella organisation for all DMVs. DMV is a state-level government agency that administers vehicle registration and driver licensing.

The company was founded by an ex-fire department employee in 1994. As this was prior to 9/11, DMVs were still open to working with private vendors. The founder of Intellicheck had good relationships with AMMVA. He was going on meetings with DMVs directors and, as a result of good contacts, was able to build these relationships and obtain this information. Moreover, Intellicheck had major security clearances while working with the military, which helped to earn DMVs’ trust. Intellicheck’s part of the relationships was checking whether or not they are complying with the format for free, which allowed DMVs to save a substantial amount of money. Surprisingly, according to the founder of the company, no-one else had been approaching DMVs at this time. Eventually, Intellicheck built relationships with all 50 DMVs.

The way this relationship works now is when a DMV comes out with a new barcode format with a digital signature buried in it, it will go to one of three companies that produce licenses for them. Intellicheck is a kind of a test facility of two of those three companies. Those companies will build the prototypes based on the DMV’s spec and then they’ll send them to Intellicheck for verification. Intellicheck will come back with some corrections on their prototype.

The relationships of Intellicheck with AAMVA and DMV are still strong. Intellicheck is on the Board of Directors of AAMVA, and they have recently celebrated the 21st anniversary together.

There are a couple of reasons why another company cannot easily build relationships with DMVs and provide authentication similar to Intellicheck. Firstly, DMVs are very reluctant to share this kind of data with anyone for security reasons. Secondly, a competitor would need to have relationships with all 50 DMVs to provide its offering to big retailers and financial institutions. Therefore, it should be extremely challenging to copy Intellicheck’s edge, and the fact that no-one did it so far validates this.

Other players in the ID checking industry use Optical Character Recognition (OCR) and some combine it with manual review. The process of OCR is to scan the document and then use pattern recognition or feature recognition to determine whether it is real or fake. However, the problem with pattern recognition is that it needs to have enough data to understand whether the ID is real or fake. During its training process, it also learns from fake IDs, which makes it less accurate. Moreover, when a new format of a license is released by the state, pattern recognition would have trouble to verify it. Feature recognition just uses a template of how the driving license should look like. Both of these result in substantially lower accuracy. For comparison, IDN has 95% to 99%, whereas competitors have 65% to 85% accuracy rates. Furthermore, competitors need special equipment for their ID checking, and, therefore, it is too expensive for stores to install them.

Since Intellicheck only checks barcodes against a database, its cost per scan is lower, and hence, it can price its offering substantially cheaper. While Intellicheck charges $0.2 – $0.4 per scan, its competitors charge ~ $0.8 and higher. This price discrepancy also gives Intellicheck some pricing power. As Intellicheck is more accurate and cheaper, it can increase its pricing, while still being a good ROI for its customers. For example, the CEO said that ‘we have a retail big-box client we’ve been working with since 2013 with over 1100 locations whose contract renewed in February. Driven by the effectiveness of our services, we were able to increase fees 56% and renewal.’[3]

Some of the competitors are Jumios, Onfidos, Authentix, Miteks, Onfido, Acuant and Authenteq. The CEO claims that they have never lost a client to one of the competitors face to face. I will not go into detail about them. Their offerings are mostly online. They are very similar among each other, and they only scan the documents without actually authenticating them.

Management

The CEO of Intellicheck is Bryan Lewis since February 2018. Bryan has a sales background. Since 2000, he has worked in sales roles in various organisations, such as BondDesk, TheMarkets.com, Reuters and Barra. Most of the companies where he worked got sold. Before joining Intellicheck, he was CEO of Third Bridge. Third Bridge is one of the largest research providers. Bryan joined the company when it was 9 million in revenue and unprofitable. In 4 years, he grew this company to be 19 million and made it profitable. The company was sold to a PE firm.

Therefore, Bryan is Hired Hand. He joined the business from an unrelated industry with some experience of Intellicheck’s customer base. There is a risk with this kind of CEOs, as they are mostly cost-cutters rather than revenue builders. There is also a limited track record of him managing the business. Nevertheless, he has an operating background and his expertise in sales is exactly what Intellicheck needed. So far, during his 3 years of tenure, he has done a great job in changing the direction of the business towards banks and retailers instead of the government, improving the company’s brand and marketing and achieving very positive financial results. Moreover, his experience selling the business is probably a knowledge that would be useful to Intellicheck at some point in the future (more on it in the “catalyst” section). The CEO’s interest is aligned with shareholders, as he owns 1.3% of the company. CFO’s interest is also aligned, as he owns 2.5%.

In terms of capital allocation, the company has not been generating any cash, so there is no evidence for judging it. One positive note is that the CEO decided not to buy a facial recognition company and instead partnered with it because these companies were too expensive. From his words, these companies had little revenue, no or almost no profitability and the same offerings, but they were valuing themselves very expensive based on the growing fraud market. His rationale is to wait until one of them goes bust and acquire it in an asset sale. This indicates that he might be a good capital allocator. As the company generates more cash, he is planning to reinvest it back into the business and hire more salespeople. In terms of acquisitions, he would like to buy camera technology or facial recognition.

Key-Value Drivers

6.1. Revenue

6.1.1. Cross-selling, Signing New Clients and Up-selling

As discussed in the beginning, the main revenue is coming from banks and retailers. As of Q3, ~92% of SaaS revenue was attributed to them. The strategy of Intellicheck is after signing a financial institution, it cross-sells the product to its retailers. As a financial institution is on the hook for the majority of fraud losses, it is incentivised to push the Intellicheck to retailers. Retailers get discounts on fees after installing Intellicheck. Consequently, after signing a bank, Intellicheck does not need to spend too much marketing efforts to get retailers.

Intellicheck already signed 5 out of 10 of the biggest US banks. According to the management estimates, each bank represents $15m – $25m TAM ($20m on average). This estimation only applies to one use case, private label credit card (PLCC) account openings, which is the main use case. This use case alone provides $75m – $125m ($100m on average) opportunity from already signed banks. The current penetration of its current banks is only around 16% for this use case.

To estimate this, I first calculated revenue per merchant pre-COVID. I took 4Q SaaS revenue annualised of $10.2m, multiplied it by 92% (revenue from banks and retailers according to management), multiplied it by 90% (estimated of revenue from PLCC account openings from top 5 banks), divided it by the number of implementations (36) and discounted it by 20% for seasonality. This results in ~$190k per merchant. I took 4Q SaaS revenue as other quarters are distorted by the timing of implementations. Then, I took my estimate for average pre-COVID revenue per merchant of $190k, multiplied it by the number of retailers the company implemented (68) and divided by PLCC account openings TAM from signed banks (average $100m). This results in 16% penetration ($16m of account openings revenue).

After signing a bank, Intellicheck can upsell its other products to call centres and branches. Similarly, after Intellicheck signs a retailer for PLCC account openings, it has an opportunity to upsell other products. Intellicheck is currently very low on penetration with them. This is now one of the main strategies for Intellicheck, according to management. For this reason, the company hired a new VP of Sales, Mike Ehlers, and is planning to expand its sales team. These other products are account look-ups, non-receipted returns, buy online, pick up in-store and online solutions.

Account look-ups is when a consumer forgot her credit card and wants to charge the purchase against it. According to the management, the scans for account look-ups are 4 to 5 times the volume of scans for a new account opening.[4] This means TAM from each bank present an opportunity of at least $80m for account look-ups ($20m PLCC * 4).

In terms of non-receipted returns, receipt less return fraud costs the retail industry $9.7bn a year with an average loss under this crime around $1,700 per incident.[5] This means 5.7m scans are fraudulent. In the 2018 4Q Earnings Call, the management presented statistics that retailers average fraud rate was 2.7%, while law enforcement fraud rate was 7%. This implies 81.5m – 211.3m scans for retailers. At $0.3 per scan, this is $24.5m – $63.4m (average $44m) TAM for Intellicheck.

I have not calculated pick up in-store, but this should be substantially lower than non-receipted returns. For online solutions, the market is huge, but it is also very competitive. At the moment, online solutions are less than 10% of revenue. Intellicheck still has an accuracy advantage over competitors and similar OCR and facial recognition offerings. As banks would prefer to use the same product for all use cases, it gives a real opportunity for Intellicheck to become their online solution.

Inteliicheck has good potential to sign the other 5 biggest banks. From my experts calls and management calls, it seems like they have a good chance to do so. However, banks are very slow to move. The process can take 2 to 3 years. For each next bank it signs, there is a $100m opportunity from account openings and account look-ups. Intellicheck’s sales team is heavily incentivized by the high commission to bring new clients.

To conclude, Intellicheck’s current run rate is ~ $11m, and it has an opportunity to get to at least to $500m after fully penetrating its current clients for PLCC account openings and account look-ups use cases. Furthermore, there is a $100m opportunity for each next bank it signs. On top of this, there is an opportunity of $43.4m from non-receipted return and an opportunity from upselling other use cases to banks and retailers.

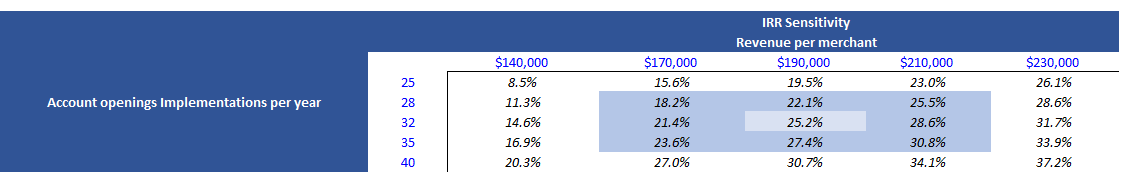

6.1.2. Implementations

After determining Intellicheck’s opportunity, the question is how fast it can get there. Retailers can make installations only during the first 3 quarters because the 4th quarter is the peak season for most of them. The company had 3 implementations in 2018, 36 in 2019 and 29 in the last 3 quarters. 2018 is when they started going after retailers, which explains the low number of implementations. 2020 got impacted by COVID, and the company still completed a solid number of integrations. At the moment, Intellicheck has ~40 retailers in the pipeline for 2021. There are 68 merchant accounts using Intellicheck, which equals to ~14 per bank. Based on average $20m PLCC account openings TAM and $190k per merchant, there are ~105 merchants per bank or 525 merchants per 5 signed banks. This means Intellicheck signed 14 merchants out of 105 for each bank or 68 merchants out of total 525 from signed banks. If it can continue to do at least 32 retail implementations per year, this means the company can get to $43m in 5 years from account openings use case only.

6.1.3. Expansion into new markets and Optionality

Intellicheck started to expand into other verticals, such as auto dealerships, elective surgeries, hospitals and humanitarian organisations. At 2019 1Q Earnings, the CEO mentioned that

“New markets are opening up as well. Hospital groups get hit with insurance fraud and we have begun contracting with hospital groups for authentication. The same for auto dealerships. We’re up to six dealer groups that have contracted for Retail ID and have signed an agreement with one of the providers of dealer management software to incorporate Retail ID in their suite of products.”

CEO explains the dealership opportunity as follows:

“I think that for the auto dealers, that’s the reason that we are — for my preference for that, is there are really three main dealer management systems, DMS as they call it. My preference is to sell it to them to then sell it out, because they have got an incentive to do it both ways, because they can now prove because most of these DMS systems make money on — there is like a lending tree model. They get paid for every application that they send to a bank for credit. So, they now know that they are sending only good applications, because it’s a real card.

The auto store owner knows that they don’t have to worry about having an expensive car drive off the lot and never come back. So, this is one where we think I am not always a huge fan of reseller arrangements, because it’s not always aligned. This is a really good enhancement to their products and they seem excited to go out and sell it”[6]

In Q3 2019, the company finished integration with the automotive dealership digital compliance enforcement platform. This opens up over 500 auto dealerships as potential clients as Intellicheck pursue this new vertical market through logical partnerships. Intellicheck will charge them per store.

Moreover, the company recently signed the largest humanitarian organisation in the United States. “This nationally renowned and respected organization provides emergency assistance and disaster relief and is starting with the use case that authenticates military service people in the field applying for aid. And let’s not forget that there is no hardware required which is that much more critical when you’re operating in the most difficult environments typical of natural disasters.”[7]

This demonstrates how wide is the application of Intellicheck’s product. There are other potential markets to which the company can expand, such as insurance, travel, telecom, gaming and shared economy. The need for authentication can expand even further. Some theoretical examples are authentication to rent AirBnB, authentication for phone unlocking and authentication for change of details in some information critical accounts. Moreover, age ID authentication can become a requirement for shops and bars.

6.1.4. End of COVID

When COVID ends, the number of scans for retailers should increase substantially. Based on my estimations, revenue per retailer was $190k in 2019 compared to $134k in 2020. There was no decrease in pricing. Therefore, the revenue should have significant acceleration from the increase in volume.

6.2 Operating margin

Intellicheck’s SaaS product has 90% gross margin and is very scalable. The company’s current gross margin is slightly lower because of hardware sales. The company can continue to push its product to banks and retailers to expand revenue while keeping other expenses low. Intellicheck has 60% – 80% incremental EBITDA margin. As the company grows, it is expected that it will hire more salespeople. The management projects 10% – 15% growth in operating expenses year over year for the near term.

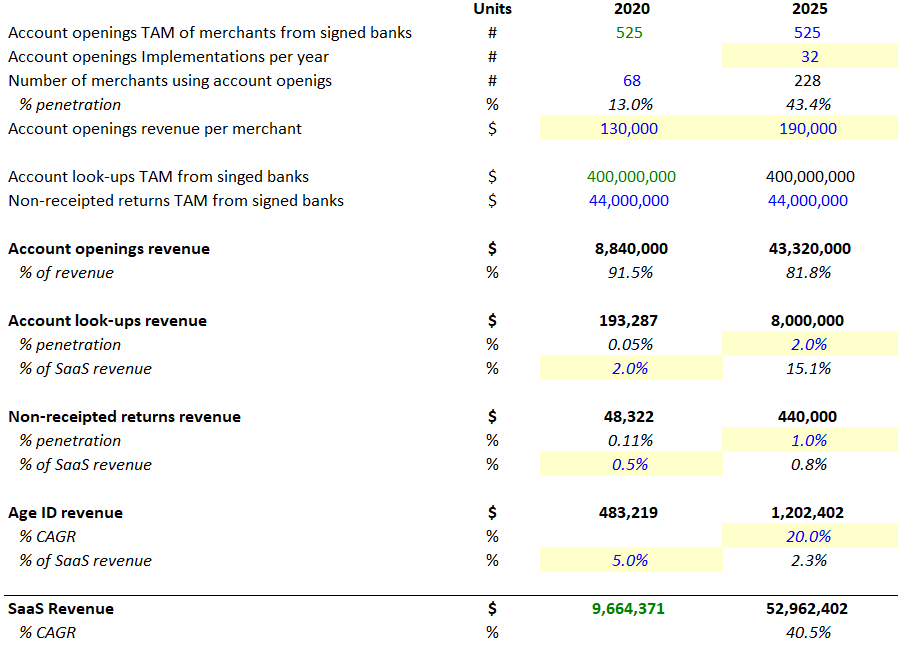

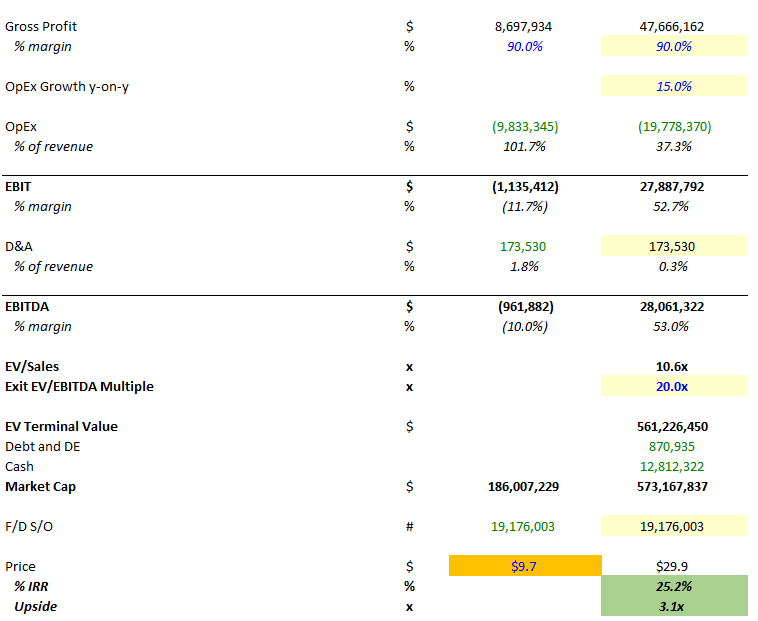

Valuation

I estimated SaaS revenue 2025 by projecting account openings implementations, penetration of account openings TAM from signed banks, penetration of non-receipted returns and growth of Age ID. I expect the company to complete around 32 implementations a year and return to pre-COVID revenue per merchant of $190k. This results in 228 total implementations (43% penetration from signed banks) by 2025 and $43m revenue from account openings. For account look-ups, I assume conservatively 2% penetration from $400m TAM of signed banks, which equals to $8m. I estimate $440k from non-receipted returns based on 1% penetration of average 44m non-receipted returns TAM. Finally, I project Age ID to grow 20% CAGR from $480k to $1.2m. To sum up, this results in $53m SaaS revenue in 2025.

For the EBITDA margin, I take the current gross margin of 90%, project 15% operating expenses growth year-on-year based on the upper range on the management’s estimate and expect D&A to remain the same. This equals to ~52% margin or $27.4m of EBITDA.

At 20x EBITDA exit and $12m net debt, this is ~$560m market cap company by 2025. Assuming the same F/D S/O of 19.2m, the company would be worth around $29 (25% IRR or 3.0x upside from the current price of $9.7). My valuation does not account for cash build-up or share dilution from options. 20x EBITDA should be reasonable for a business with 52% EBITDA margin, very little assets and still medium penetration of signed banks.

I believe that my assumptions were conservative. Intellicheck can have a significantly higher rate of implementations and higher penetration of account look-ups and non-receipted returns. My estimations do not account for expansion into new verticals or other top 5 banks. Moreover, OpEx can probably grow below 15%, taking into account that the company does not need many investments to grow further.

Catalysts

There is no need for a catalyst for my thesis. The company will grow its revenue and margins, which will increase the value of the company.

Nevertheless, the company is a good acquisition target. Intellicheck’s relationship with DMVs and knowledge of how to decode a barcode on a driving license is a valuable asset. Acquiring Intellicheck makes sense for companies that can bundle its service. Logical buyers are companies that do knowledge-based authentication. Some examples are Credit Bureau and LexisNexis. The CEO has experience in selling a company, as he sold his previous one. The CEO said that he does not want to sell to PE firms, as they offer a small premium.

The Company Exists for more than 20 years. Why is it only a ~200m market cap with such a moat and potential opportunities?

There are two main reasons. Firstly, the previous CEO was ex-military and his strategy was to focus on selling to the military and police. These customers have a long sales cycle, they have to be done in person and they are not scalable. Secondly, in the past, retailers’ scanners could not scan 2D barcodes on driving licenses. Therefore, they were required to buy equipment to install Intellicheck, which was a bad ROI for retailers. Both of these factors changed since the arrival of the new CEO, who focuses on banks and retailers, and since the adoption of 2D barcodes by retailers.

Risks

10.1. Execution

The opportunity for Intellicheck is there. The problem might be that the management might not be able to seize it. At the moment, the company is limited to employees and very early in penetration rates and use cases. As the company scales, the company will face different types of challenges compared to what the management is used to.

10.2. Fraud of Barcodes

Fraudsters can get more advanced and start to fake barcodes. This would decrease the value proposition of Intellicheck and its accuracy rates.

10.3. Data Breach

Intellicheck might have a data breach. This would make DMVs and banks more reluctant to work with them.

10.4. Adoption of Chips for Driving Licenses

AMVVA can decide to adopt chips in driving licenses similar to Europe. This would make Intellicheck’s solution obsolete. On this, the CEO said that it is impossible to make 50 DMVs to agree on something and that chips are too expensive for the DMV’s budget.

10.5. DMV give access to competitors or stops working with IDN

While this is unlikely for the reasons mentioned before, this is still a possibility.

10.6. New Technologies from Competitors

Someone can come up with a new technology that can have similar or better accuracy than IDN at the same or cheaper price.

10.7. Shrinking TAM in Offline Retail

As retail is shifting to e-commerce, TAM for Intellicheck is shrinking. However, this shrinkage is not significant, considering that the retail market is still growing.

EDIT: I made a mistake in the Pre-COVID revenue per merchant calculation since I took the number of new implementations for the FY19 (36) rather than the total number of implementations (39). Therefore, the rest of the calculations are a little bit off as well. Adjustment for the mistake would increase revenue and EBITDA. However, I did not make changes in the thesis, since it does not change anything.

Thanks to Miguel Neto for noticing.

- Verizon’s 2019 Data Breach Investigation Report ↑

- 2020_Q3_IDN_Earnings_Call ↑

- 2019_4Q_IDN ↑

- 2020_Q3_Earnings_Call ↑

- 2019_Q1_Earnings_Call ↑

- 2019_1Q_IDN ↑

- 2020_Q3_IDN ↑